Why Would a Water Damage Claim Be Denied? Common Reasons and How to Overcome Them

Table of Contents

The cleanup after water damage strikes is a whole lot of work–but finding out, on top of that, that your insurance claim has been denied can take things to a catastrophic level. However, a denied water damage claim leading to stalled projects and financial pressure is not something you have to accept.

Claim Supplement Pro specializes in the whys and hows of claims. We’re here to help you understand why a water damage claim might be denied in the first place, as well as how you can turn that denial into approval. The right documentation, supplementing strategies, and professional support can enable the reversal of denials, allowing you to recover the funds you need for a full restoration.

How Insurance Companies Handle Water Damage Claims

When a water damage claim is filed, the insurance company follows a fairly standard process. First comes the initial inspection, where an adjuster is sent to assess the extent of the damage. That inspection is followed by a review of the policy to determine whether the type of water damage is covered, and finally, a decision on how much the insurer is willing to pay for restoration.

But here’s where problems arise: many denials don’t happen because the damage isn’t real, but because the documentation provided wasn’t detailed enough. This means contractors and property owners can find themselves with an unexpected denial even when the loss seems obvious.

That’s why it’s so important to understand the most common reasons water damage claims are denied, as this knowledge can help you anticipate issues before they derail your recovery.

The Most Common Reasons a Water Damage Claim Is Denied

If the damage is obvious, then why would a water damage claim be denied? The truth is that insurance companies deny water damage claims for a variety of reasons, and many of them come down to how quickly the claim was filed, how well the damage was documented, and how the policy language is interpreted. The good news? Once you understand the most common reasons, you also understand how to prevent or overcome them.

Late Reporting or Delayed Notification

Water damage claims must be reported as quickly as possible. When reporting is delayed, insurers may argue that the damage worsened due to inaction and that negligence voids coverage. Quick communication and immediate documentation are critical to avoiding this pitfall.

Lack of Proper Documentation

If the adjuster doesn’t see enough proof, the claim can be justifiably denied. Missing moisture mapping, before-and-after photos, and mitigation invoices are common gaps. Contractors are especially important here, as detailed interior water damage documentation can make or break the outcome.

Policy Exclusions for Gradual Damage

Many policies exclude long-term leaks, mold, or wear-and-tear. However, it’s important to note that hidden causes of leaks or water damage are not usually considered gradual damage; in most cases, they still qualify as sudden and accidental. Knowing this distinction is key to challenging an improper denial.

Water Damage Claim Denied Due to Maintenance Issues or Negligence

If it is determined that a property owner failed to address a known issue, such as a leaking pipe, insurers can deny the claim on the grounds of poor maintenance. In cases where the water event was sudden (rather than the result of neglect), thorough and timely documentation is a must.

Wrong Classification of Water Source

Another frequent reason for denial is misclassification of the cause of loss. For example, a burst pipe inside the home is usually covered, while floodwater from outside often requires a separate policy. If the water source is documented incorrectly, the claim can be denied outright. It is important to ensure the correct classification from the start.

Coverage Limits and Deductibles

Sometimes the claim isn’t truly “denied,” it’s capped or reduced due to policy limits and deductibles. Although this might feel frustrating, in many cases, these underpayments can be supplemented, giving contractors and owners a way to push for a fair payout.

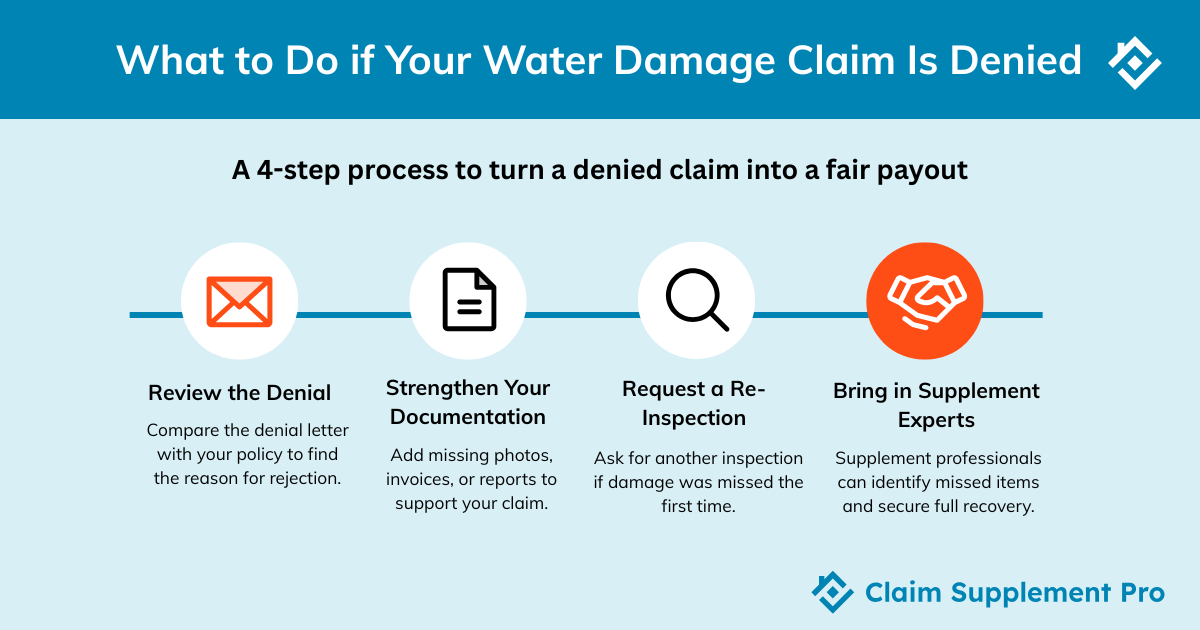

What to Do if Your Water Damage Claim Is Denied

We understand that having your water damage claim denied may feel like a dead end, but we also know that it doesn’t have to be. A denial isn’t the final word. Contractors and property owners have multiple strategies to challenge a decision and turn it around. But you must stay organized, strengthen your case, and know when to bring in expert help.

Review the Denial Letter and Policy Language

The first step is to carefully review the denial letter. Request the insurer’s reasoning in writing and compare it directly with your policy terms. This helps you identify whether the denial is based on an exclusion, missing documentation, or a simple misinterpretation of coverage.

Strengthen Documentation and Re-Submit

Most denials can be overturned with stronger documentation. Add what may have been missing the first time, like more detailed contractor estimates, invoices, moisture maps, and mitigation reports. The golden rule is that the more thorough the documentation is, the greater your chances of securing the necessary funds for repairs.

Request a Re-Inspection or Independent Evaluation

If the first inspection missed critical damage, don’t hesitate to request another. Contractors can provide their own scope of work to highlight overlooked areas. Supplements are particularly effective here, as they justify additional costs with line-item detail.

Partner with Claim Supplement Experts

Sometimes, the fastest way to move from a denied water damage insurance claim to full approval is bringing in a supplement professional. Claim Supplement Pro specializes in both water mitigation and flood insurance claim supplements, identifying missed items, reframing claims with proper documentation, and negotiating with insurers for maximum recovery.

Frequently Asked Questions About Denied Water Damage Claims

Why would insurance deny a water damage claim?

Reasons may include late reporting, missing documentation, policy exclusions, maintenance issues, or misclassification of the water source.

What is one of the most common reasons for a claim being rejected?

One of the biggest reasons is poor or incomplete documentation. Without moisture maps, mitigation invoices, and detailed photos, insurers may argue there’s not enough proof of damage.

How does insurance work for water damage?

Coverage usually depends on whether the damage was sudden and accidental versus gradual. Burst pipes or appliance malfunctions are typically covered, while slow leaks or wear-and-tear often are not. Policies also set limits, deductibles, and may exclude certain events like flooding, which requires separate coverage.

Can a denied water damage claim be appealed?

Yes. Property owners and contractors can submit additional documentation, request a re-inspection, or file a supplement to show the full scope of loss. With proper records and expert support, many denied water damage claims can be overturned.

Don’t Let a Denied Claim Leave You Underwater

A denied claim isn’t the end of the road; it’s just a hurdle. Property owners and contractors face denials more often than you’d think, but most can be challenged and corrected with the right strategy. The key lies in strong documentation, persistence, and professional support.

At Claim Supplement Pro, we specialize in water mitigation and flood supplements that uncover missed costs, justify overlooked damages, and help secure the payout needed for full recovery. Don’t settle for less than you deserve. Partner with experts who know how to turn denials around.