What to Do If Your Insurance Claim Was Underpaid

Table of Contents

- What Is an Underpaid Insurance Claim?

- Why Do Insurance Companies Underpay Claims?

- Signs Your Insurance Claim Was Underpaid

- Steps to Take If Your Insurance Claim Was Underpaid

- What Happens If the Insurance Company Doesn’t Pay Enough?

- How Contractors Can Support Property Owners With Underpaid Claims

- Mistakes to Avoid When Dealing With Underpaid Claims

- Real-World Examples of Underpaid Insurance Claims

- Underpaid Claims Don’t Have to Be the Final Word

- Frequently Asked Questions About Underpaid Insurance Claims

In the midst of going through property damage after a storm, the one thing that could make you feel better is the expected financial support from your insurance. Yet all too often, policyholders and contractors receive a check that barely scratches the surface of the real repair costs.

This occurrence is what’s known as an underpaid insurance claim, meaning the insurer did pay something, but not nearly enough to cover what it actually takes to restore the property to its pre-loss condition. And it’s a frustrating place to be. You’re left wondering how to cover the shortfall, while feeling the pressure of completing projects with budgets that don’t reflect the true scope of work.

The good news is, you’re not stuck with that initial payout. Underpaid claims are common, but so is challenging and correcting them. We’ll explain why this happens, how you can fix it, and the role of supplement specialists in your recovery of the full amount of what you’re owed.

What Is an Underpaid Insurance Claim?

An underpaid insurance claim is a coverage of the loss that doesn’t fully cover the costs of repairing the damage. It’s important to distinguish between this and a denied claim, where coverage is outright refused. An underpaid claim acknowledges the loss, but it undervalues it.

For example, imagine a roof repair estimate comes in at $25,000, but the insurance company only issues a check for $12,000. Or consider water mitigation work totaling $8,000, with the insurer offering just $3,000. In both cases, you’re left covering the gap, even though the extent of the damage warrants full coverage.

However, if your insurance company underpaid your claim, you’re not alone in this. With the right documentation and our expertise, underpaid insurance claims can be supplemented.

Why Do Insurance Companies Underpay Claims?

When a claim payment doesn’t match the true cost of repairs, it doesn’t mean that someone set out to shortchange you. Insurance claims are complex, and underpayments often come down to differences in estimates, missing documentation, or how policy terms are applied. Understanding why these gaps happen is the first step toward closing them.

Common Ways That Payouts May Be Reduced

- Underestimating costs. Adjusters may use standard pricing databases that don’t reflect current material or labor costs in your area.

- Omitting line items. Essential details like code-required upgrades, specialized labor, or certain materials may be left out of the estimate.

- Misclassifying damage. A problem mislabeled as “wear and tear” instead of storm damage, for example, can significantly reduce payment.

- Policy exclusions. Sometimes exclusions are applied too broadly, leaving necessary repairs partially covered.

Property Types Most Affected

- Residential homeowners. Roof repairs, water mitigation, and interior damage are frequent sources of underpaid claims.

- Commercial property owners. Larger buildings with complex systems often face bigger discrepancies, especially with roofing and water damage.

That’s why reviewing your settlement with a professional can make all the difference. Claim supplement specialists spot missing items, correct misclassifications, and document the true repair costs to help you recover what you’re owed.

Signs Your Insurance Claim Was Underpaid

Sometimes, it’s obvious your claim was underpaid. Other times, the gap is hidden in the details. Here are common red flags to look for:

- Payout doesn’t match your contractor’s estimate. If the approved amount is far below what it actually costs to repair, that’s a warning sign.

- Missing coverage for labor or material costs. Important line items like specialty materials, debris removal, or subcontracted work are sometimes left out.

- The adjuster missed hidden damage. Not all damage is visible at first glance; for example, water behind walls or underlying roof issues can easily be overlooked.

- Overlooked building code requirements. Bringing a property up to current code is often necessary during repairs, but those expenses aren’t always included.

What Not to Say to an Insurance Claim Adjuster

Be mindful when speaking with an adjuster; it’s best to avoid making assumptions about the extent of damage, minimizing the problem, or casually agreeing with their assessment without review. Statements that downplay the damage or suggest you don’t need a professional opinion can work against you. Instead, stick to clear facts, provide supporting documentation, and let experts handle the technical details.

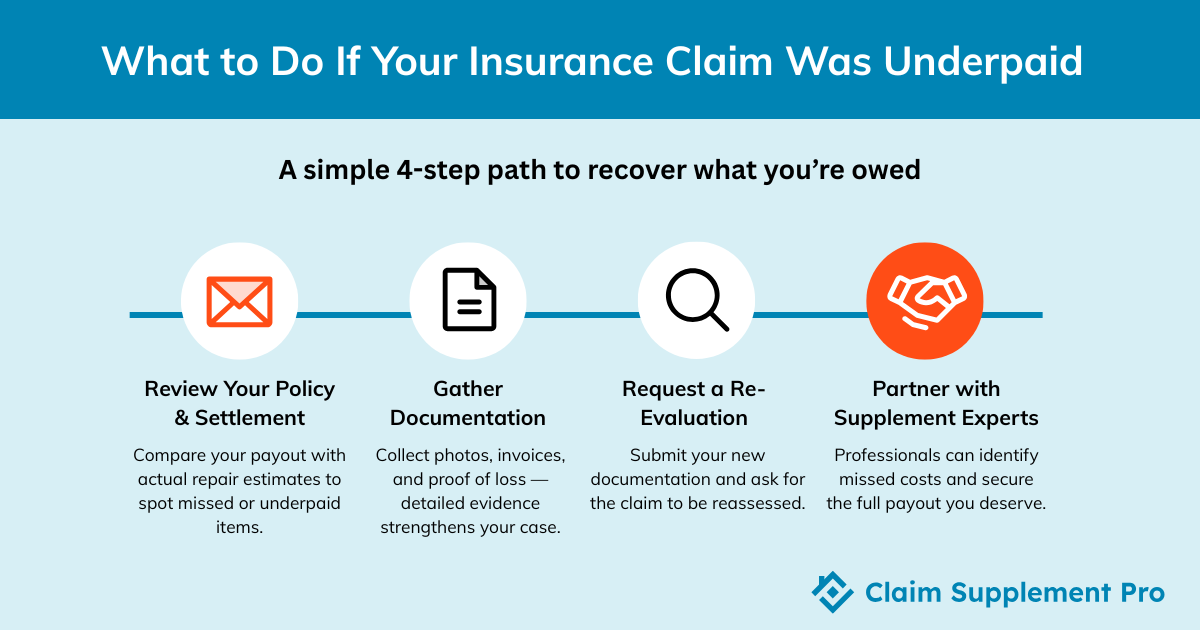

Steps to Take If Your Insurance Claim Was Underpaid

As discouraging as realizing the insurance payout won’t cover repairs can feel, keep in mind that it’s not the end of the road. There are clear, structured steps you can take to challenge an underpayment and recover what’s fair, and we’re not prone to gatekeeping.

Review Your Policy and Settlement

Start by carefully reviewing your policy to understand what’s covered, what’s excluded, and how deductibles are applied. Then, compare the insurance company’s payout against real repair estimates from contractors. This often highlights where costs have been underestimated or line items overlooked.

Gather Documentation

Documentation is your strongest tool. Collect photos of the damage, contractor estimates, invoices, and a detailed proof of loss. The more precise and organized your records are, the easier it becomes to demonstrate where the insurer’s settlement falls short. This is the foundation for filing a supplement request.

Request a Claim Re-Evaluation

If you spot discrepancies, you can ask the insurer to review the claim again with additional documentation. In cases where disagreements persist, you may also request an appraisal or bring in a Public Adjuster to ensure the claim is fairly valued.

Work with a Claim Supplement Specialist

Professional help can make all the difference. We’re your partners in reviewing estimates, uncovering missed line items, and resubmitting claims with complete documentation. By reframing the claim with accuracy and detail, supplements often lead to significantly higher payouts without inflating your costs.

What Happens If the Insurance Company Doesn’t Pay Enough?

So, how do you resolve an underpaid claim? You have several avenues to remove this roadblock, and the best approach depends on the situation and timeline.

- Negotiate or Submit a Supplement

The first step should be submitting a supplement request. This includes updated documentation, contractor estimates, and any overlooked damage. We are witnesses that many underpaid claims are resolved at this stage once the insurer has the full picture.

- Mediation or Appraisal

If negotiations stall, policies often allow for mediation or appraisal. This is essentially a neutral third-party review where both sides present evidence, and an independent appraiser helps determine a fair settlement amount.

- Involving an Attorney

If all else fails, legal action is still an option, though this is generally the last resort due to time and cost. Attorneys can step in if you feel that insurers refuse to negotiate in good faith.

It’s also important to remember that timelines matter. Most policies and state laws have statutes of limitations on when you can dispute or supplement a claim, so acting quickly is critical.

How Contractors Can Support Property Owners With Underpaid Claims

When a property owner receives an underpaid settlement, they often feel frustrated and unsure of what to do next. Contractors can play a critical role not only in restoring the property but also in guiding homeowners through the insurance process.

Educating Clients

Most property owners don’t realize that underpayment is common in insurance claims. You can help by explaining reasons like overlooked line items, missed code upgrades, or underestimated repair costs. By showing how supplements are not “padding the bill” but simply ensuring all necessary work is covered, contractors protect their clients and build trust.

Leveraging Supplement Services

You don’t have to handle the paperwork and negotiations alone. Partnering with experts providing supplement services gives you the backup you need to secure accurate payouts. We know how to identify missed damage, prepare detailed documentation, and work directly with insurers. This knowledge results in higher approval rates, faster claim resolutions, and more satisfied clients who appreciate your support.

Mistakes to Avoid When Dealing With Underpaid Claims

It’s important not to sabotage yourself and weaken your own chances of recovering the full settlement. Avoid these common mistakes that can make the difference between walking away short-changed and securing fair compensation.

Settling too quickly without reviewing the payout

Insurance companies sometimes present a fast settlement offer, but quick doesn’t always mean complete. Take time to compare the payout with actual repair estimates before agreeing.

Accepting the insurer’s first offer

The general rule is that the first offer is rarely the best. Claims are often underestimated, so accepting without question usually leaves essential repairs unfunded.

Failing to document everything

Photos, invoices, estimates, and even communication records are crucial. Without detailed documentation, it becomes difficult to justify supplements or disputes later.

Saying the wrong things to adjusters

While professionalism is key, be mindful of how you communicate. Avoid speculating or downplaying the extent of the damage. Stick to facts and documented evidence.

Real-World Examples of Underpaid Insurance Claims

The best way to understand the power of supplementing is to look at real situations contractors and property owners have faced.

Commercial Roof Repair

A commercial property owner received an initial insurance payout that fell far short of covering the true repair costs. The insurer’s estimate overlooked necessary code upgrades and underestimated material costs. After submitting a supplement with full documentation, the claim was increased by more than $50,000, so the roof was restored to proper standards.

This scenario is common—learn more about why most commercial roof insurance claims are underpaid.

Residential Water Damage

A contractor dealing with extensive water mitigation was initially paid just a fraction of what was needed for his work. Similar situations are detailed in our guide on underpaid water damage insurance claims. The insurance company’s estimate didn’t account for hidden structural damage or true labor costs. With contractor input and a detailed supplement, the claim amount was nearly doubled, allowing the completion of repairs without financial strain.

Underpaid claims aren’t the end of the story. With the right documentation and supplement process, fair outcomes are achievable.

Underpaid Claims Don’t Have to Be the Final Word

An underpaid insurance claim is far more common than most people realize, and it’s not a dead end. With the right steps and expert support, you can recover the full compensation necessary to restore a property properly. The key is not to wait or accept less than what repairs truly cost.

If you suspect your claim was underpaid, take action now. Our team is here to help review, document, and supplement so nothing gets overlooked.

Talk to a supplement specialist today to recover the full payout you deserve.

Frequently Asked Questions About Underpaid Insurance Claims

What is an underpaid claim?

An underpaid claim happens when the insurance company approves your claim but pays less than the actual cost of restoring the damage. It means some legitimate repair costs were overlooked or undervalued, and you can dispute it to recover the difference.

How long do I have to dispute an underpaid claim?

The timeframe depends on your state and your insurance policy, but most policies have strict deadlines (often one to two years) for disputing or supplementing a claim. It’s best not to wait, since delays can weaken your case. Review your policy for exact timelines and start the process as soon as you notice the payout is insufficient.

Do I need a lawyer if my insurance claim is underpaid?

Not always. Many underpaid claims can be corrected through a supplement process with detailed documentation, contractor estimates, and support from claim supplement specialists. A lawyer may be necessary only if the insurer refuses to reconsider or is acting in bad faith. For most cases, working with supplement experts is faster, less costly, and highly effective.

What happens if I accept the underpaid settlement?

If you sign off on an underpaid settlement and cash the check without disputing it, you may lose the right to request additional funds later. This could leave you covering repair costs out of pocket. Before accepting, compare the payout with contractor estimates and consider supplementing the claim. Once accepted, it’s often final.