What Are Insurance Claim Supplements? (A Complete Guide for Contractors and Property Owners)

Table of Contents

- Understanding the Basics — What Is an Insurance Supplement?

- How Does the Supplement Process Work?

- Why Are Insurance Supplements So Important?

- Examples of Insurance Claim Supplements

- How Claim Supplement Pro Helps You Secure the Full Value of Your Claim

- Types of Claims Claim Supplement Pro Covers

- Common Questions About Insurance Claim Supplements

- Related Reading and Resources

- Every Detail Counts — And So Does Every Dollar

Insurance claim supplements are one of the most misunderstood parts of the property restoration process. The confusion, in our opinion, often comes down to the term itself; supplement can make it sound like an optional add-on, when in fact, it’s a critical step to correct an incomplete or underpaid insurance claim. Many property owners, and even some contractors, don’t realize that supplements exist to ensure every legitimate repair cost is properly covered, not to inflate the claim.

That’s why this guide breaks down your whole “WHW” wondering – what claim supplements are, how they work, and why they’re essential for getting your project fully funded from start to finish.

If your original insurance claim was underpaid or denied, Claim Supplement Pro can help recover the missing funds and manage the supplement process on your behalf. To learn more about low settlements, see our post on steps to take if your insurance claim was underpaid.

Understanding the Basics — What Is an Insurance Supplement?

An insurance claim supplement is an additional request submitted to the insurance company after the original claim has been paid or approved. It’s used to cover legitimate repair costs that were overlooked, underpaid, or discovered later once restoration work began. In other words, a supplement for insurance claim helps bring the payout in line with the actual scope of damage.

Supplements often come into play after contractors start the job and uncover issues that weren’t visible during the first inspection.

For example, a roof replacement might reveal damaged decking beneath the shingles that wasn’t listed in the original insurance estimate. These kinds of situations best teach what is a supplement on an insurance claim, as it then needs to be filed to request additional funds for the uncovered repairs.

Claim supplement specialists can handle this process on your behalf, having the expertise necessary for helping you carefully prepare the documentation, revised estimates, and photos insurers require to approve the adjustment.

Understanding these basics is key to managing both residential and commercial insurance claims effectively, since the supplement process can vary depending on the property type and scope of damage.

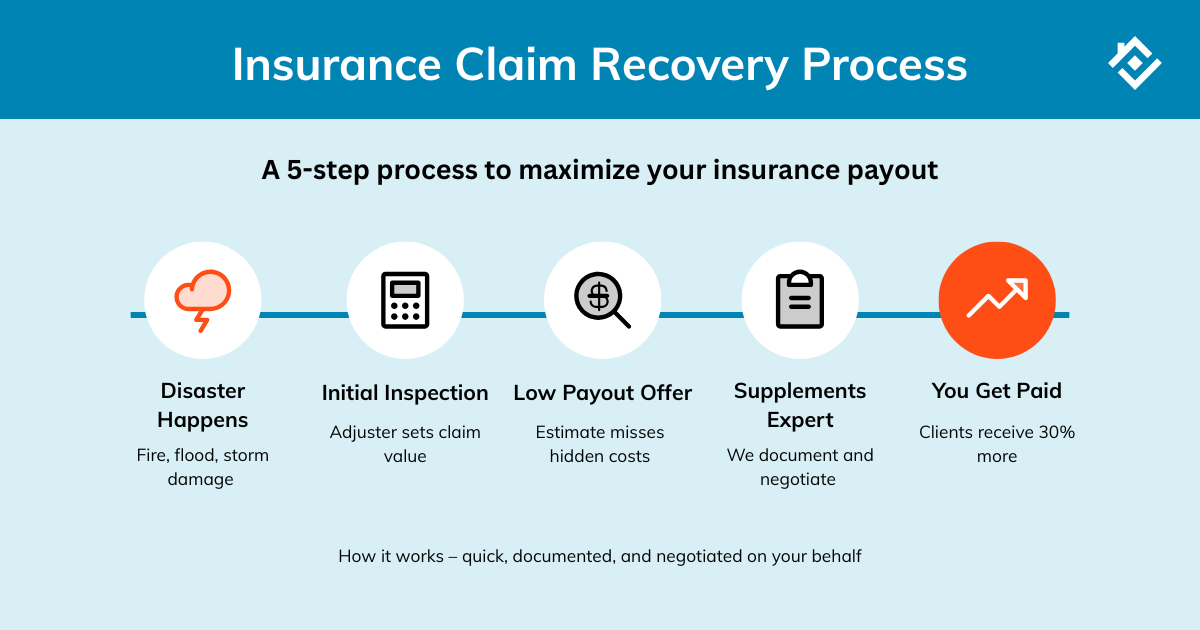

How Does the Supplement Process Work?

You don’t always know a fruit’s gone bad until you open it. Similarly, it’s common to realize only once the damage repairs begin that the initial insurance estimate didn’t capture everything. The insurance claim supplement process exists to correct those gaps and ensure the project is funded based on the real scope of work. Let’s break down how it typically works, step by step.

Step 1: Discovering Additional or Hidden Damage

Most supplements begin the moment contractors uncover damage that wasn’t visible during the first inspection. Roofing projects, in particular, often reveal extra repair needs once the shingles come off, such as missing flashing, worn underlayment, or damaged drip edges, gutters, and ridge vents. Other frequently missed elements include water and ice shields, soffit vents, gable vents, rubber boots around roof penetrations, or even skylight repairs.

None of these are simply add-ons but essential components that ensure the roof is weatherproof and code-compliant. However, since adjusters can only perform limited surface inspections, such issues often remain undiscovered until work starts, leading to legitimate supplemental claims.

Step 2: Creating a Detailed Supplement Estimate

Once additional damage is identified, the next step is to prepare a comprehensive supplement estimate. Professional estimating services like Claim Supplement Pro use Xactimate to create itemized and accurately priced repair estimates.

This ensures every component, labor cost, and code requirement is properly documented and aligned with insurance guidelines while representing the true cost of restoration

Step 3: Submitting Documentation to the Insurance Company

A strong supplement submission includes more than just a revised estimate. You’ll have to attach photos of the additional damage, invoices, building code references, and manufacturer specifications that support each repair.

Missing or unclear documentation is one of the main reasons supplements get delayed or denied, so organization and precision are imperative.

Step 4: Negotiation and Approval

Once the documentation is received, the insurance adjuster reviews the file and may request clarification or a reinspection. At this stage, experience matters the most; professionals who understand claim language and pricing systems can effectively negotiate to ensure all legitimate repair costs are approved.

With the right support, most supplements are resolved without conflict, and even the lowest initial estimates can end up resulting in fair compensation and a fully funded restoration project.

Why Are Insurance Supplements So Important?

An insurance supplemental claim plays a crucial role in protecting both contractors and property owners from financial loss. When an insurance company’s initial estimate falls short, the missing funds have to come from somewhere—and without a supplement, that somewhere is often your own pocket.

Filing a supplement ensures that every legitimate repair is properly funded, allowing your jobs to meet code-required upgrades and manufacturer-specified materials. It’s not about adding extras, but about completing the job the right way; safely, legally, and to professional standards.

For contractors, supplements also safeguard profitability. Without them, your team ends up covering labor, materials, or time that the insurer overlooked. For property owners, they mean peace of mind knowing that their home or building will be fully restored, not just patched up.

Always document every additional repair with clear photos, itemized estimates, and references to local building codes. Solid documentation is the foundation of a successful supplement.

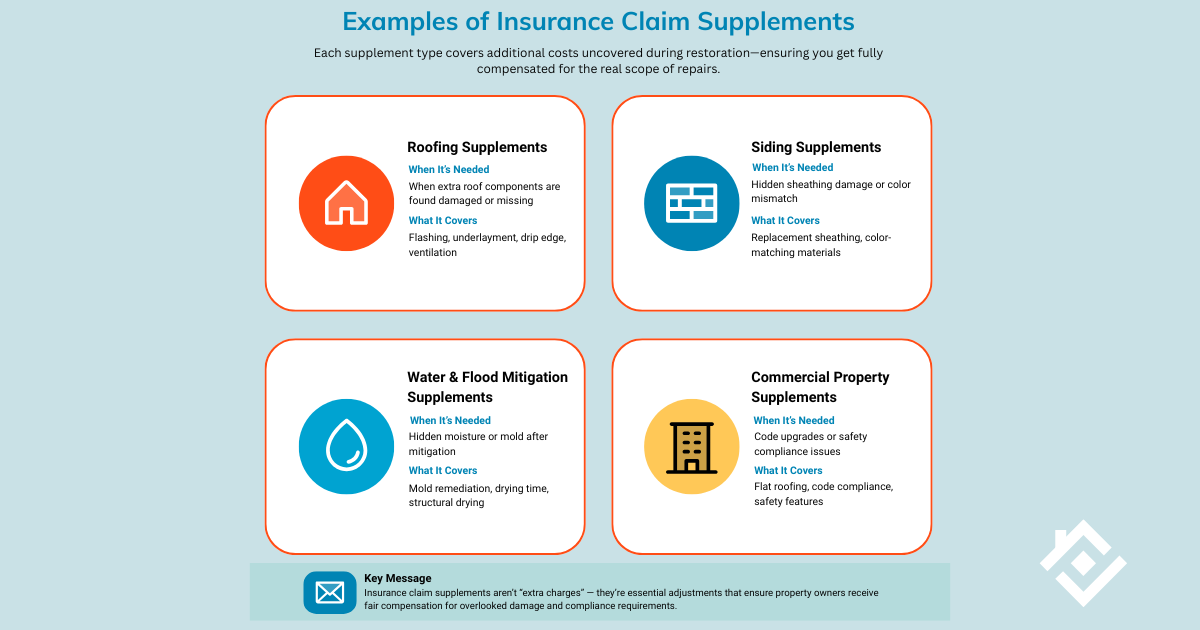

Examples of Insurance Claim Supplements

Insurance claim supplements come in many forms, depending on the type of property and the kind of damage uncovered during restoration. Let’s go over a few common examples that illustrate what an insurance supplement might include:

- Roofing Supplements

When additional roof components are found to be damaged or missing from the original estimate, a supplement can cover them. Common items include damaged flashing, upgraded underlayment, drip edge, or ventilation components that must be replaced to meet code. - Siding Supplements

A supplement may be required if hidden sheathing damage is discovered during siding replacement or if there’s a color mismatch that affects the property’s appearance. However, it’s important to note that some insurance policies exclude matching. - Water Mitigation or Flood Supplements

After water damage, supplements often cover necessary procedures like mold remediation, additional drying time, or structural drying that wasn’t accounted for in the initial estimate. - Commercial Property Supplements

In commercial settings, supplements can include costs for building code upgrades, flat roofing materials, or safety compliance requirements that exceed the scope of the first payout.

Clearly, the best answer to the question of what is an insurance supplement is that it’s a vital part of ensuring that every aspect of the repair is properly funded and completed to standard.

Without supplements, essential work often goes unpaid, or in the worst-case scenario, skipped. Supplements ensure that both contractors and property owners have the resources to complete the job safely, correctly, and without cutting corners.

How Claim Supplement Pro Helps You Secure the Full Value of Your Claim

The thing standing between a delayed payout and a fair, properly funded restoration might be partnering with experienced supplement professionals. Claim Supplement Pro bridges that gap by helping contractors and property owners achieve faster approvals, accurate estimates, and complete compensation for all verified damages.

When it comes to self-talk, we’d rather let our results speak:

- On average, our team increases approved claim amounts by 30% or more through detailed documentation and expert estimating.

- That often means thousands of additional dollars recovered for legitimate, code-compliant repairs that would otherwise go unpaid.

With our specialists managing the documentation, communication, and negotiation, you can stay focused on restoration. Meanwhile, we’ll make sure your claim gets the attention it deserves.

Contact Claim Supplement Pro today to see how we can help you recover the funds you’re owed.

Types of Claims Claim Supplement Pro Covers

Insurance claims come in many forms because property damage itself can take countless shapes and sizes. Each type of claim has its own documentation needs, code requirements, and repair complexities, which is why supplements must be tailored to the specific situation.

Our team works with contractors and property owners on all major types of property damage claims, including:

Be it overlooked roof components or missing line items in large commercial projects, Claim Supplement Pro makes sure every legitimate repair and code-required upgrade is properly recognized and paid for.

Common Questions About Insurance Claim Supplements

What Are Supplements on an Insurance Claim?

Supplements are additional requests made after the initial insurance claim to cover damages or repair costs that were missed or undervalued in the original estimate. They ensure that all legitimate repairs are properly funded, not left out of the payout.

What Is a Supplement Claim?

A supplement claim is an extension of your original insurance claim, submitted when new or previously overlooked damages are discovered during the repair process. It’s not a new claim but an adjustment to make the existing one complete.

What Is an Example of an Insurance Supplement?

A common example is a roofing job where hidden damage to decking is uncovered after work begins. The contractor files a supplement to have those additional materials and repairs approved and paid for by the insurer.

What Is an Insurance Supplement Payment?

Once the insurance company reviews and approves the supplement, it issues an additional payment to cover the verified costs that were not included in the initial payout. This ensures the total compensation matches the actual repair needs.

What Not to Say to an Insurance Adjuster?

Avoid guessing or downplaying damage, and stick to verified facts and documentation only. Clear, accurate communication helps prevent misunderstandings that can lead to underpayments or insurance claims getting denied altogether.

Who Pays for Supplemental Insurance or Supplements?

The insurance company covers the cost of approved supplements. As long as the added items are legitimate and properly documented, neither the contractor nor the property owner should be paying out of pocket.

Related Reading and Resources

In case this article sparked your interest to dig into more detail on the topic of supplements for insurance claims, check out our related guides for practical tips and detailed insights:

- Navigating Flood Claim Supplements

- 6 Costly Mistakes Contractors Make on Commercial Property Damage Claims

- How to Document Interior Water Damage for a Stronger Insurance Supplement

- Understanding the Commercial Supplement Process

- What Contractors Should Communicate to Homeowners Before Submitting Roof Repair Estimates

- The Fire Restoration Contractor’s Guide to Insurance Claim Supplements

Every Detail Counts — And So Does Every Dollar

Insurance supplements aren’t extras — they’re the difference between partial and proper restoration. Having experts on your side ensures you’re on the right end of that spectrum, fully compensated for every legitimate repair.

Behind every successful supplement is meticulous documentation; every photo, line item, and code reference matters. A missed detail means missed money, which is why precision in review and submission makes all the difference.

Don’t settle for less than what your project truly needs; contact Claim Supplement Pro and make sure every covered dollar comes back to you.