Roof Insurance Claim Denied? Steps to Appeal and Get Paid

Table of Contents

- Why Do Insurance Companies Deny Roof Claims? (Common Reasons Explained)

- What To Do Immediately If Your Roof Claim Is Denied

- How to Fight a Denied Roof Damage Claim

- Step-by-Step Process to Reopen or Supplement a Denied Roof Claim

- How Claim Supplement Pro Helps With a Denied Roof Claim

- Preventing Future Roof Claim Denials (Contractor & Homeowner Best Practices)

- Frequently Asked Questions About Denied Roof Insurance Claims

- Final Thoughts — A Denied Roof Claim Doesn’t Mean You Won’t Get Paid

A denied roof insurance claim can feel infuriating–even plain wrong. Keep in mind, however, that a denial letter doesn’t necessarily mean the damage was reviewed correctly or that additional payment is off the table.

Roof claims are denied every day because photos are weak, or estimates lack support that insurers expect to see. This guide comes as a handy tool that explains why denials happen, what steps come next, how negotiations and supplements work, and when outside help changes the outcome.

You will also see how Claim Supplement Pro supports contractors and property owners going after warranted unpaid dollars.

Why Do Insurance Companies Deny Roof Claims? (Common Reasons Explained)

Insurance companies often follow a set process when evaluating roof claims. Inspectors check visible damage, compare it to the policy, and consider weather records. After that, internal reviews look for strong, clear documentation.

A denied roof claim often has less to do with actual damage and more to do with the file’s technical gaps. Photos, measurements, or estimates that don’t match the insurer’s expectations can undermine the claim before it gets serious attention.

Contractors and homeowners can anticipate where claims hit the wall when they know how insurers analyze them.

The next sections go through the main reasons roof claims are denied.

Wear and Tear vs. Storm Damage

Storm damage doesn’t always look obvious. In many cases, wind bruising hides under shingles, and hail impacts can be missed during the initial inspection.

Shallow inspections leave those signs out of the report, and miscategorization happens more than it should.

Adjusters may miss storm-related damage when there’s tight photo framing and small test sections. Without thorough documentation and a complete scope of damage, the insurer’s version of the roof becomes the one that sticks.

Insufficient or Incomplete Documentation

Documentation is where many roof claims crumble, as photos may make a single area the focal point, while other slopes go unseen. Meanwhile, both adjusters and contractors might skip test squares or take only brief measurements, leaving gaps in the roof’s documented condition.

Yet, the first step towards a meticulous review is having this key proof.

Rushed inspections are another risk factor. Some reports are hasty and written under time pressure.

This is how details get compressed, and damage descriptions stay vague. But that summary determines how the file is viewed moving forward once it enters the file.

Professional estimating must follow a high standard. Knowledgeable estimators capture explicit measurements and line items tied to visible damage, so the pricing and repair scope match to the T.

Missed Deadlines and Late Reporting

Insurance policies set strict timelines for reporting roof damage. Others expect prompt action once damage becomes visible. Insurers gain a strong argument to reduce or deny payment when that window closes.

Delays diminish roof claims in practical ways, as damage changes over time and property owners may make temporary fixes. Plus, if inspections happen later than they should, insurers could have reasons to question when the damage occurred and how it started.

This is where what contractors should advise homeowners early goes from beneficial to vital. Homeowners need to report suspected damage fast, even if the roof looks intact.

Remember that waiting removes options. Early notice protects the claim file and makes the storm impact central.

Damage Excluded by Policy Language

Insurance policies differ in what they cover. Named perils policies cover only the causes listed in the contract, while all-risk policies protect against a wider range of events.

Cosmetic damage (e.g., dents on metal roofs) usually isn’t covered when the roof is still fully working. How a policy is interpreted can change what counts as a covered loss.

Keep in mind that only a licensed Public Adjuster can discuss policy with the insurance company. At the same time, property owners and contractors should learn how exclusions work to understand what can be documented and supplemented without getting stalled over policy language.

What To Do Immediately If Your Roof Claim Is Denied

You should know what to do if a roof claim is denied, as this is indispensable for protecting your options. Acting quickly helps ensure everything gets deserved attention.

The first steps center around assembling all documentation and thoroughly reviewing the denial. After that, confirm what evidence is lacking.

Request the Full Denial Letter and Claim File

In a case of a denied roof claim, the first step is getting the full denial letter and the complete claim file. Look closely at the explanations for any vague statements or unsupported conclusions.

Any notes that overlook certain areas or use vague language can point to gaps that need addressing. You must evaluate the entire file to see what was missed and plan the next steps for an appeal or supplement.

Review Your Policy Coverage Line by Line

The next step is to review the insurance policy carefully, line by line, and pay close attention to:

- Which types of damage are covered

- How coverage limits apply

- Any exclusions that could affect your roof claim

Watch for wording insurers may point to when denying specific items, such as cosmetic damage or code upgrades. Get yourself familiar with the exact terms to clarify whether a denial is tied to policy language or how the damage was described.

If coverage interpretation becomes an issue, a licensed Public Adjuster is the only professional who can discuss policy details directly with the adjuster.

Get an Independent Roof Inspection (or Request a Re-Inspection)

An independent roof inspection tends to be a must for a well-rounded story. Adjusters often work under time limits and fixed checklists, while contractors spend more time on the roof and understand the repair scope.

Details almost always pinpoint that difference. Robust photo evidence and clear damage mapping strengthen the claim and help correct what was missed.

A re-inspection should include this level of documentation so that no one misses damaged areas or understates repair needs.

How to Fight a Denied Roof Damage Claim

Not every denied roof damage claim needs the same response. Some situations call for pushing back on the original decision, while others need the addition of new information to the file.

Whether damage was missed or conditions changed after the first inspection, you have to know which path fits the situation to save time and remove dead ends from the equation. Go for the approach that matches the insurer’s citations in the denial, the evidence, and whether the claim was underpaid or closed too soon.

Appealing a Fully Denied Roof Claim

A fully denied roof claim can still be disputed without escalating into a legal fight. The process centers around asking the insurer to take another look at the decision using stronger support.

Every response should address the exact reasons listed in the denial. This means:

- Clear photos

- Accurate measurements

- A scope that reflects what proper repairs require

- Weather data, inspection notes, and updated estimates can connect the damage to a covered event.

Personal opinions have little to no importance at this stage. Insurers respond to documentation that matches their review standards.

Supplementing an Underpaid or Partially Denied Claim

A claim supplement adds omitted work and pricing after an insurer issues payment that doesn’t cover the full repair. It answers what work was required but left out of the original estimate. This is often why your roof damage insurance claim needs to be supplemented, especially after a fast inspection or limited scope approval.

Underpaid claims tend to miss real job costs that show up once work begins. Common gaps include:

- Labor tied to existing conditions

- Code upgrades required for replacement

- Steep or high access charges

- Disposal and safety measures

These omissions explain why most commercial roof insurance claims are underpaid and why partial approvals feel like denials in disguise. A concise supplement backed by proper documentation helps correct those gaps and push payment closer to the true cost of repair.

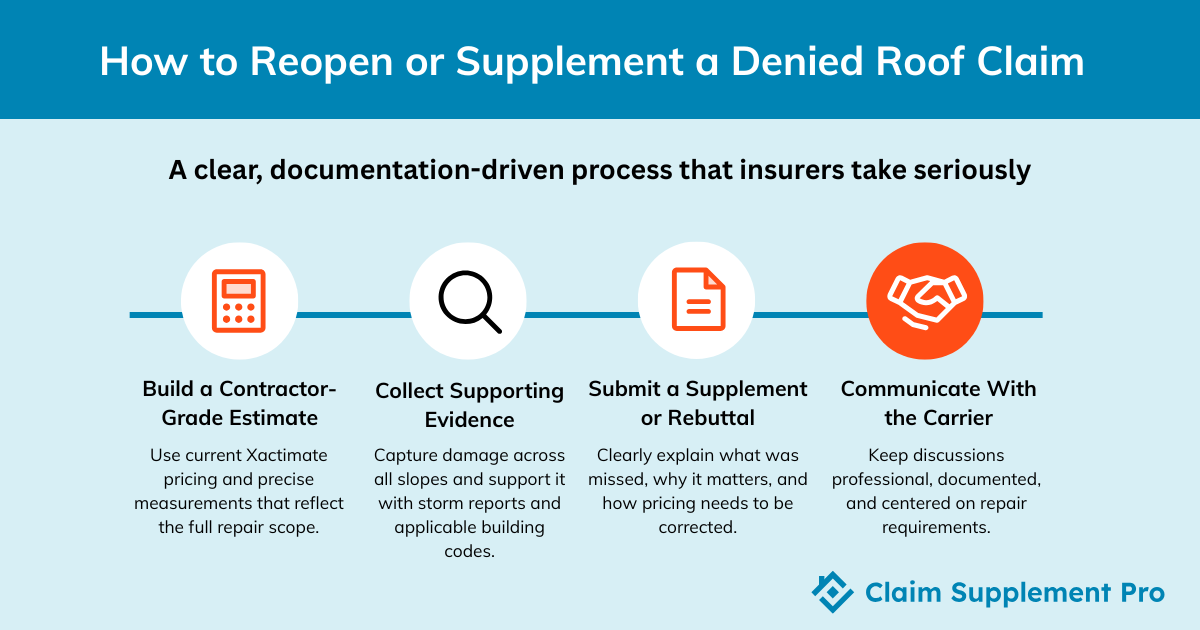

Step-by-Step Process to Reopen or Supplement a Denied Roof Claim

Step 1 – Build a Contractor-Grade Estimate

A strong estimate starts with immaculate accuracy. Xactimate pricing should reflect current labor and material costs, with line items that match the real repair scope.

Each component needs to connect directly to observed damage. This is also where what contractors should tell homeowners before submitting roof estimates becomes crucial. Homeowners need to understand that early numbers may change once the full scope is documented and the repair begins.

Step 2 – Collect Supporting Evidence

Evidence turns an estimate into a defensible claim. Photos should show damage clearly across all slopes (and not just problem areas).

Weather reports tie damage to a specific event. Local building codes support required upgrades that insurers often leave out.

However, missing or weak evidence remains one of the most common reasons roof claims are denied.

Step 3 – Submit a Formal Supplement or Rebuttal

Supplements should follow a structured format with clear justification for each added item. Casual emails and loose explanations tend to stall progress.

Insurers respond better to claim language that’s in line with their review standards and explains why payment needs adjustment.

Step 4 – Communicate Strategically With the Carrier

Be aware that every interaction determines the outcome. Stick to documented facts and scope-related issues, leaving no room for speculation or emotional arguments.

How Claim Supplement Pro Helps With a Denied Roof Claim

Claim Supplement Pro works as a technical claims partner focused on documentation, estimating, and process support.

Our focus stays on building clean, defensible files that carriers can review without friction.

Expert Roof Claim Supplementation

Denied and underpaid claims receive a full technical review tied to visible damage and repair scope. Each file starts anew with detailed photos and accurate measurements.

Roofing supplements are prepared to align evidence and carrier standards in one clear package. Facts and professionalism remain the main components of communication, keeping the discussion centered on scope and cost support.

Professional Estimating Services

Accurate estimates change the claims’ trajectory speed. On the flip side, incomplete pricing and vague scopes invite pushback.

Detailed estimates give carriers less room to dispute line items. Estimating services support contractors who need well-rounded documentation and property owners who want a claim that mirrors the true repair cost.

Contractor-Focused Support That Protects Homeowners

Support stays grounded in scope, documentation, as well as estimate accuracy, without drifting into legal arguments or coverage disputes. Strong documentation accelerates reviews and keeps repeated questions at bay. Contractors maintain control of their scope, while homeowners gain clearer outcomes without unnecessary delays. After all, carriers can verify the work much more easily with proper files.

Preventing Future Roof Claim Denials (Contractor & Homeowner Best Practices)

What Contractors Should Do Before Submitting Roof Claims

Strong claims start on the roof because inspections need straightforward standards that hold up under carrier review. Photos should show context and close detail, taken with intent.

Measurements must match the structure, and notes should clearly explain the damage–including areas where a water leak due to roofing hail damage may appear.

Documentation works best as a system, so a comprehensive checklist keeps gaps out of the file and saves time later.

That discipline turns estimates into tenable records. Some contractors treat this as an afterthought, yet it sits at the core of the roofing contractor’s guide to fewer denials and faster approvals.

What Homeowners Should Know Before Filing

Timing determines outcomes more than people expect. Delayed reporting raises questions that may never fully disappear, even with visible damage.

Early reporting and the right contractor are central to how a claim unfolds. Clear timing and a carefully written scope reduce questions and put damage at the forefront.

Mistakes often come from good intentions. Casual statements and missing photos can limit your course of action later. Property owners who slow the first step often move through the rest with greater obstacles and increased frustration.

Frequently Asked Questions About Denied Roof Insurance Claims

Why was my roof claim denied after inspection?

Denials often follow inspections that document wear, installation issues, or damage framed as maintenance instead of storm impact–even when repairs feel urgent.

Can a denied roof claim be reopened?

A denied roof claim can reopen once new evidence appears, such as missed damage, corrected measurements, or a revised scope that addresses the carrier’s objections.

How long do I have to appeal a roof claim denial?

Appeal windows depend on policy language and state rules, though many policies allow several months before rights start to narrow.

Does supplementing a claim increase approval chances?

Claim supplements often improve outcomes because they correct omissions and pricing gaps that lead adjusters to undervalue legitimate repairs.

Can contractors fight roof claim denials?

Contractors cannot dispute policy coverage, yet they can support denied roof claims through documentation, estimates, and technical explanations that strengthen reconsideration.

Final Thoughts — A Denied Roof Claim Doesn’t Mean You Won’t Get Paid

A denied roof insurance claim can feel like the end of the line. Keep in mind, however, that many outcomes change once the file accurately documents the loss. Property owners and contractors come up against denials related to issues such as scope gaps, pricing errors, or even missed damage.

Fixes exist with evidence and carrier language in place. Claim Supplement Pro reviews claims with a technical lens and a strong knowledge of the insurance industry. Contact Claim Supplement Pro to review your claim and understand what can still be corrected.