How to Handle Mold Growth in Water Damage Claims

Table of Contents

- Understanding Mold Growth in Water Damage Claims: Why It Happens and Why It Matters

- Does Insurance Cover Mold from Water Damage?

- Common Signs of Mold After Water Damage (And How to Recognize Them Early)

- What Contractors and Homeowners Should Do Immediately When Mold Growth Is Suspected

- How Contractors Should Document Mold Growth to Support a Supplement

- The Mold Remediation Process: What Insurers Expect and What Contractors Must Include

- How to Negotiate Mold Damage Supplements and Handle Pushback From Insurance Adjusters

- When to Bring in a Claim Supplement Expert

- Mold Claim Examples

- To Sum Up: Quick Answers to Common Mold Claim Questions

- When to Hire a Claim Supplement Professional to Strengthen Your Mold Damage Payout

- Break the Mold Before Mold Breaks Your Claim

Where there is moisture, there is mold. It has a way of sneaking into a property after the water itself is gone, turning a simple dry-out into a much bigger problem. It spreads quietly, hides well, and shows up at the worst possible time, usually right when you think everything is getting taken care of and the claim is moving forward. That’s why mold is one of the biggest reasons water damage claims get delayed, trimmed down, or written off entirely, even when the evidence is right there.

Homeowners just want straight answers. Contractors want a clean scope and a claim that actually reflects the work ahead. Both groups end up dealing with the same headache when mold enters the picture: mold damage claims are more complicated, more expensive, and far more likely to be challenged unless everything is documented with precision.

We’ll walk you through everything you should know regarding this matter, all the way from spotting mold early, recording it the right way, understanding how coverage works, to preparing supplements that hold up under scrutiny instead of getting pushed aside. As experts in water damage claim supplements, we’ve seen how the right approach can shift a claim from frustrating to fully supported, and that’s exactly what you’ll learn here.

Understanding Mold Growth in Water Damage Claims: Why It Happens and Why It Matters

Mold doesn’t wait for anyone. Once moisture settles into drywall, flooring, insulation, or the air itself, growth can begin in as little as 24–48 hours. Even a brief leak or a “small” water event can turn into a mold issue before the homeowner has time to process what happened. And to make matters worse, both the CDC and EPA agree that mold growth can cause a variety of health effects.

However, not all water losses make mold behave the same way. Category 1 clean water might start harmlessly, but once it sits, it quickly behaves like Category 2 (grey water). And anything involving Category 3 water, which is sewage, flooding, or contaminated sources, creates an environment where mold can spread aggressively and requires far stricter remediation standards. This is why insurers look at mold with a tighter lens than standard water damage; once mold is involved, the scope changes fast.

Left unaddressed, mold drives up repair costs, forces additional tear-outs, impacts indoor air quality, and can make a space temporarily unlivable. For you as a contractor, that means more labor, more materials, more protective procedures, and more documentation, all of which need to be reflected in mold damage claims to avoid an underpaid job.

Does Insurance Cover Mold from Water Damage?

Mold coverage lives in a gray zone. Sometimes it’s covered fully, sometimes partially, and sometimes not at all, and the difference usually comes down to how the water damage started and how quickly it was addressed.

Standard Homeowners Policies and Mold Exclusions

Most policies exclude mold caused by long-term leaks, neglected maintenance, or anything considered “ongoing.” Insurers typically only cover mold that follows a sudden and accidental water event. Even then, many policies impose mold sub-limits, often $5,000–$15,000, regardless of the actual repair cost.

When Mold Is Covered in a Water Damage Claim

Mold is usually covered when it’s a direct result of a covered water loss. For example, a pipe bursts, water sits before the inspection, and mold develops. That’s a typical eligible scenario that answers your question of can I claim mold damage positively. If it stems from a covered event, it can be covered. But you’ll have to be able to prove it.

Mold Endorsements and Expanded Coverage Options

Some policyholders add mold endorsements that significantly increase coverage limits. These riders cost extra but can be the difference between partial reimbursement and a realistic mold remediation budget.

When Mold Damage Is Likely to Be Denied

Claims are often denied when mold develops from everyday humidity, long-term seepage, or a failure to mitigate quickly. If the loss appears preventable, insurers push back. However, a water damage claim might get denied even when you claim it for all the right reasons if you don’t provide proper documentation or don’t supplement on time. And to do everything right and on time, you have to recognize it first.

Common Signs of Mold After Water Damage (And How to Recognize Them Early)

Mold doesn’t always announce itself with a visible cloud of spores. Discoloration, streaks, or fuzzy growth on walls, ceilings, baseboards, and flooring are common indicators. A musty or pungent odor reminiscent of cat urine can also signal mold, even when nothing is visible to the naked eye.

Hidden mold often develops in less obvious areas: inside wall cavities, under cabinets, beneath subflooring, between the finished floor and subfloor, behind drywall, or within HVAC systems. It can appear quickly after water intrusion and worsen if not addressed promptly.

But how to claim mold damage? How do you prove you’ve been exposed to mold when it’s not obvious? This is a crucial point from an insurance perspective. It means documenting both visible and hidden growth with photos, moisture readings, and professional inspection reports. Early recognition protects your health, but recognition combined with thorough documentation is imperative to strengthen your water damage insurance claim and to give you a better foundation for supplements or additional coverage.

What Contractors and Homeowners Should Do Immediately When Mold Growth Is Suspected

When mold shows up after water damage, timing is everything. A small patch can turn into a full remediation project in a matter of days, and insurance decisions often depend on what you do in those first few steps. Acting quickly protects the property, strengthens the claim, and prevents insurers from classifying the issue as ‘maintenance’ or ‘long-term’; two descriptions you definitely don’t want on your file.

Step 1 — Stop the Source of Water and Begin Drying

As we said above, mold starts forming within 24–48 hours, so the priority is cutting off the moisture and getting airflow going. You should capture moisture mapping, hygrometer readings, and photos from the very beginning. These early measurements show that the mold didn’t come from a long-term leak, which is the most common difference between a covered loss and a denied one.

Step 2 — Document All Mold Growth Thoroughly

Every patch of mold, big or small, needs to be recorded. Take wide-angle photos, close-ups, videos, and notes about odors, discoloration, damp materials, and moisture readings. This creates credible evidence that ties mold to the initial water intrusion rather than neglect.

A complete record also makes it easier to assemble a strong supplement later on, which is why we keep reminding contractors how important detailed interior documentation is when preparing a water damage insurance supplement.

Step 3 — Contact a Water Mitigation Professional (and Why DIY Cleanup Is Risky)

DIY mold cleaning, such as applying mostly water-based bleach products, almost always works against the homeowner because insurance sees it as tampering, and the mold often comes back. Professionals use containment to prevent cross-contamination, air filtration devices, HEPA vacuums, and antimicrobial treatments, all of which insurers expect to see in the mitigation phase. Calling a mitigation team early protects both the structure and the claim.

Step 4 — Notify Your Insurance Company and File the Claim Correctly

When filing a claim, wording matters. One of the most important mold insurance claim tips is that mold should be presented as secondary damage caused by the covered water event, not a standalone issue. This prevents the claim from falling under typical mold exclusions or low mold sub-limits. Keeping the description factual and tied to the original loss sets the stage for a smoother supplement process later on.

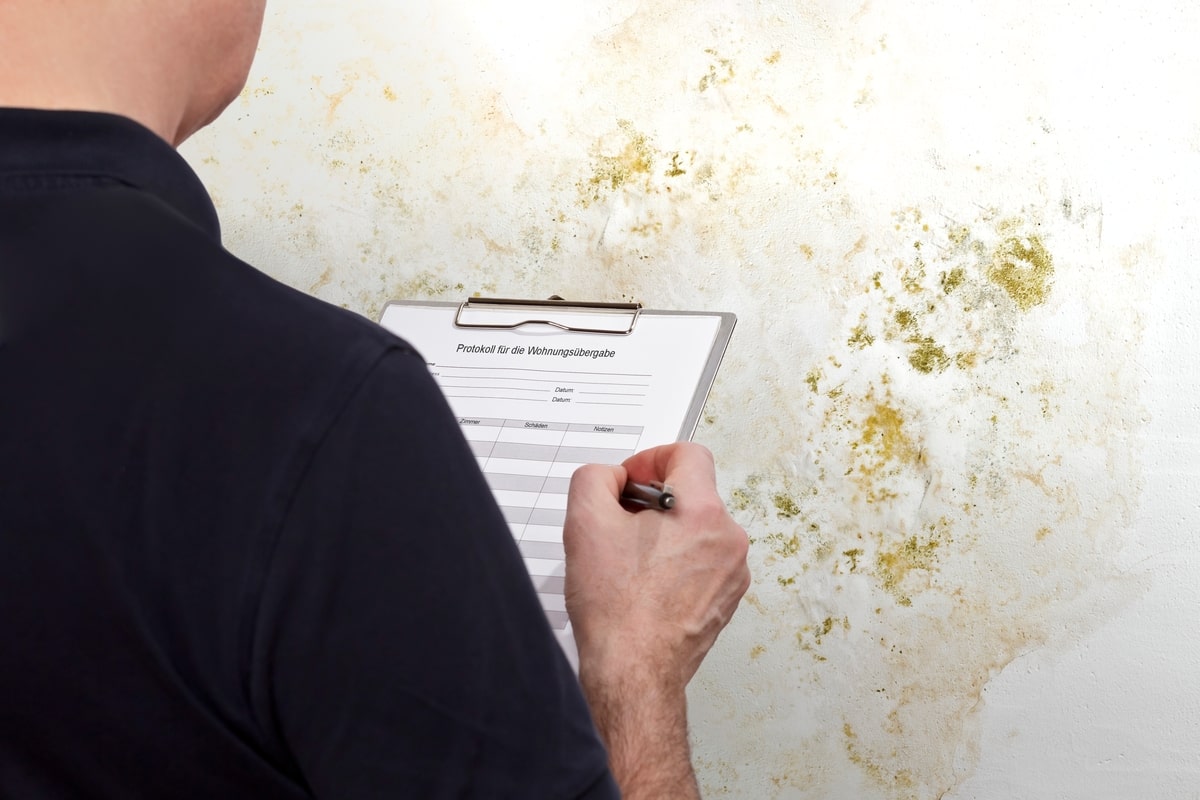

How Contractors Should Document Mold Growth to Support a Supplement

Accurate mold documentation is what determines whether a supplement gets approved or stalled. The stronger the evidence, the easier it is to show that the mold was tied to a covered water loss. Therefore, we should go over what every contractor should gather on-site.

Moisture Mapping and Hygrometer Readings

Mold doesn’t exist without moisture, and insurers know it too. Moisture maps, meter readings, and humidity logs help justify the full remediation scope. These readings also prove how far the water traveled, which supports line items like containment, removal of affected materials, and drying equipment. Consistent moisture documentation is one of the strongest defenses against the damage being labeled as “pre-existing.”

Detailed Photo/Video Sets

Photos and videos should tell the full story about what the property looked like before mitigation, what you found during removal, and how the structure looked after. Include:

- close-ups of affected materials

- wide shots showing context

- visible mold colonies

- signs of moisture spread behind walls or under flooring

- PPE (Personal Protective Equipment) and containment setup

- air filtration and negative-air equipment in use

This level of visual clarity allows you to build supplements that get approved without back-and-forth.

Using Xactimate or Other Software for Line-Item Mold Remediation Estimates

Mold remediation is a sequence of labor, materials, and safety protocols that should be reflected line by line. Estimates should account for:

- containment barriers

- PPE

- affected material removal

- negative-air machines

- HEPA vacuuming

- antimicrobial cleaning

- post-remediation testing

You can leave the details to us, as professional estimating services use software that ensures nothing gets left out and keeps the scope aligned with industry standards.

Proving Mold Was Caused by a Covered Water Loss

The supplement succeeds or fails based on one principle: causation. Adjusters look for a clean, documented chain between the original water event and the mold. That’s why you should preserve:

- timestamps on all photos

- moisture readings from the initial inspection

- proof of the original water intrusion

- prompt mitigation steps

- any evidence that the area wasn’t neglected before the loss

When presented clearly, this evidence supports full mold remediation as part of the covered water damage claim instead of leaving room for speculation about the infamous “long-term leak”.

The Mold Remediation Process: What Insurers Expect and What Contractors Must Include

Insurers will look closely at every step of your mold remediation because the difference between proper containment and a quick wipe-down can mean thousands of dollars in additional work later. The more clearly you document the process, the easier time you’ll have showing why each part of the remediation plan is necessary and tied to the covered water loss.

Establishing Containment Zones

Containment is what keeps a small patch of mold from becoming a whole-house problem. Insurers expect to see plastic barriers, zipper doors, and clear separation between affected and unaffected rooms. Good documentation shows why containment was needed, how large the controlled area was, and how it prevented spores from spreading during removal.

Negative Air Pressure and Filtration Requirements

You shouldn’t see negative air machines and air scrubbers as optional. They’re what keep mold particles from drifting into clean spaces. You should capture the setup, the equipment ratings, and the placement of ducting. This further proves cross-contamination was prevented and supports line items tied to filtration and air control.

Removal of Affected Materials vs. Cleaning

Not everything can be saved. Drywall, insulation, and porous cabinetry usually have to go once mold has settled into them. Non-porous materials and lightly affected surfaces may be cleaned instead. Insurers often want to see why removal was necessary, so showing staining, saturation, or compromised materials helps justify the scope.

Antimicrobial Treatment and Post-Remediation Verification

After removal, the job isn’t finished until the space is safe. HEPA vacuuming, antimicrobial application, and thorough wiping are the final stages insurers expect to see documented. Clearance testing, or at a minimum, post-remediation inspections, helps close the loop and shows that the space was restored properly.

How to Negotiate Mold Damage Supplements and Handle Pushback From Insurance Adjusters

Mold can often be treated as a secondary issue, as something that can be minimized, capped, or written off as pre-existing. That’s why mold supplements require more documentation, more justification, and a firmer stance than typical water mitigation supplements. Contractors who let us help them understand how adjusters evaluate mold, what triggers a denial, and how to defend their scope are the ones who consistently secure full, fair payouts.

Common Reasons Adjusters Underpay or Deny Mold Claims

Adjusters lean on some common arguments when it comes to limiting mold coverage. We’ll go over these in the form of quotes in an attempt to immediately inspire you with ideas on how to respond.

“Mold wasn’t caused by the loss.”

They might argue the growth pre-dated the event, especially for slow leaks, supply line drips, roof penetrations, or HVAC condensation issues.

“Mold wasn’t documented early enough.”

If there wasn’t a same-day inspection, clear moisture readings, or detailed photos, adjusters can claim the mold developed because you waited too long.

“The scope is excessive.”

Large containment zones, multiple air scrubbers, or extensive material removal may be labeled unnecessary without strong justification.

“Mold sub-limit caps apply.”

Carriers routinely cite policy limits—it’s their job to do so. However, you should keep in mind that if the mold resulted directly from a covered water loss, some policies allow the limits to be exceeded.

Our Ideas on Strategies to Overcome These Arguments

The strongest mold damage claims and supplements rely on proof, not persuasion or discussions.

Use timeline evidence to show rapid mold formation

Explain when the loss happened, when you arrived, and when mold was first observed. As moisture-rich materials can develop visible growth within 24–48 hours, this is a clear indication of a direct connection between the loss and the mold.

Submit moisture readings as scientific evidence

Hygrometer and moisture-mapping data prove that materials were saturated as a result of the event, supporting both causation and the need for your scope.

Reference the IICRC S520 standards to justify your methods

Containment, negative air, PPE, removal, HEPA vacuuming, and antimicrobial treatment are required when mold is present; these are not optional upgrades.

Supplement with a strengthened, itemized mold remediation scope

A line-item estimate (Xactimate or equivalent) shows the adjuster exactly what’s required and why, reducing the room for pushback.

Done correctly, your supplement shows the carrier that your scope is not inflated; it’s compliant, expected, and aligned with industry standards.

When to Bring in a Claim Supplement Expert

When navigating mold claims alone, hitting a wall is almost inevitable. We’re here to help whenever that happens, or to keep you from ever hitting it in the first place.

As supplement specialists, we can:

- Defend your scope using standards, policy language, and technical justification

- Maximize the approved payout by identifying overlooked line items and underpaid labor

- Save you hours of back-and-forth with adjusters so you can focus on your actual work

For complex losses, older homes, HVAC-related growth, or repeated denials, bringing in an expert from the start could be the factor that determines whether you recover the full remediation cost.

Mold Claim Examples

Real-world mold damage claims rarely unfold cleanly. Losses escalate quickly, documentation is inconsistent, and adjusters often assume the growth is pre-existing.

We want to use real-life examples to show you how strong documentation, proper scoping, and strategic supplementing can dramatically change the outcome of your claim.

Dishwasher Supply Line Leak — Mold Growth in Kitchen Cabinetry

A homeowner noticed a musty smell under the sink two days after a supply line failed. By the time the contractor arrived, moisture readings were high in the base cabinets and toe-kicks, and visible mold was forming along the particle board edges.

The adjuster approved drying and minor cleaning only, believing the mold likely existed prior to the loss and that removing cabinets would be excessive.

Contractor Documentation:

- Moisture mapping confirmed saturation directly tied to the loss

- Photos showed fresh mold growth confined to wet materials

- Hygrometer readings proved elevated humidity in the cabinet cavity

- Scope included cabinet removal, containment, PPE, HEPA vacuuming, negative air, and antimicrobial treatment

Supplement Result:

After submitting a detailed line-item estimate and referencing IICRC S520 requirements, the carrier approved full cabinet removal, mold remediation, and build-back.

The contractor established clear causation, justified material removal, and documented mold development within a short, loss-related timeline.

HVAC Condensate Line Backup — Mold in a Second-Floor Closet

A blocked HVAC condensate line overflowed inside an upstairs closet. The homeowner didn’t notice the issue until clothing, drywall, and trim felt damp. Mold appeared on the lower drywall within 72 hours.

The adjuster applied a low mold sub-limit that could barely cover cleaning.

Contractor Documentation:

- Moisture readings showed active saturation in drywall and framing

- Thermal imaging demonstrated the path of water from the condensate line

- Photos captured the progression from wet drywall to visible microbial growth

- The scope called for removing drywall up to the moisture line, installing containment, and running a negative air machine

After demonstrating that the loss was sudden, accidental, and directly responsible for the mold, the contractor disputed the sub-limit and received approval for the full remediation scope instead of just cosmetic cleaning.

To Sum Up: Quick Answers to Common Mold Claim Questions

Should I file an insurance claim for mold?

Yes, if the mold came from a sudden water event. Mold from long-term leaks or humidity is usually excluded, so the cause of the moisture is what determines coverage.

How do you prove you’ve been exposed to mold?

Insurance doesn’t evaluate based on personal opinions; it evaluates property conditions. Moisture readings, photos, and documentation of visible growth are what matter for a claim.

What is an example of a mold claim?

An example of a mold claim is when a homeowner files an insurance claim for mold that grew after a sudden, accidental event like a burst pipe, and the policy covers the cost of remediation and repairs.

Can I claim mold damage?

You can if the mold is secondary damage linked to a covered water loss. Mold caused by slow leaks, neglect, or poor maintenance is typically denied unless you have a mold endorsement that expands coverage.

When to Hire a Claim Supplement Professional to Strengthen Your Mold Damage Payout

A supplement expert becomes invaluable the moment mold enters the picture, for both contractors trying to justify a full remediation scope and homeowners who don’t want their claim underpaid or denied. Professionals can challenge lowball estimates, correct missing line items, and frame the mold as secondary damage tied to the covered water loss.

Bringing them in even before the adjuster visit gives you a stronger, cleaner narrative backed by solid documentation and industry standards. When the stakes are high, early guidance can prevent weeks, even months, of back-and-forth.

Whenever you need support, we’re one form-filling away – our water mitigation and flood supplements are designed for you.

Break the Mold Before Mold Breaks Your Claim

Early documentation, clear causation, and proper mitigation are what keep mold from turning a straightforward water loss into a denied or underpaid claim. With the right strategy and the right support, mold claims don’t have to feel like uphill battles. They can be won, protected, and properly supplemented when you take the process seriously from day one.