How to Handle a Smoke Damage Insurance Claim: Why Contents and Hidden Damage Often Get Missed

Table of Contents

- Understanding Smoke Damage and Why It’s Often Overlooked

- What Is Considered Smoke Damage in an Insurance Claim?

- The Smoke Damage Insurance Claim Process: Step-by-Step

- What Not to Say to an Insurance Adjuster About Smoke Damage

- Why Contents and Hidden Smoke Damage Often Get Missed

- Common Questions About Smoke Damage Insurance Claims

- How Claim Supplement Pro Helps Contractors and Property Owners Maximize Smoke Damage Claims

- Smoke Damage Claims Don’t Have to Be Suffocating

Where there’s smoke, there’s fire. And there is also smoke damage that often lingers long after the fire is out, affecting more than what’s visible to the naked eye. Walls, HVAC systems, furniture, and electronics can all absorb smoke, odors, and soot, which can be highly dangerous to your health. Yet, it often happens that insurance claims fail to cover the full extent of this damage.

This guide will help you identify both obvious and hidden signs of smoke damage, navigate the insurance claim process, and avoid underpaid or missed claims. Claim Supplement Pro specializes in fire damage insurance claim supplements, helping contractors and property owners recover the full value of their smoke and fire damage claims. Let’s make sure together that nothing goes overlooked.

Understanding Smoke Damage and Why It’s Often Overlooked

So what is smoke damage exactly? From an insurance and construction perspective, it’s the effect of smoke particles on building materials, structural components, HVAC systems, and personal belongings. Unlike fire damage, which is typically obvious, smoke damage can be hidden, as it can travel through vents, settle behind walls, or leave odors and residue that aren’t immediately visible. And that’s why things can get complicated.

Smoke particles can discolor surfaces, penetrate insulation, contaminate ductwork, and compromise electronics or furniture. Because much of this damage isn’t apparent at first glance, many smoke damage claims underrepresent the actual loss. However, as contractors often say, “If you can smell it, it’s there,” and it needs to be taken care of. You don’t necessarily have to see smoke damage for it to be costly. Even beyond material belongings, it greatly affects indoor air quality, too.

What Is Considered Smoke Damage in an Insurance Claim?

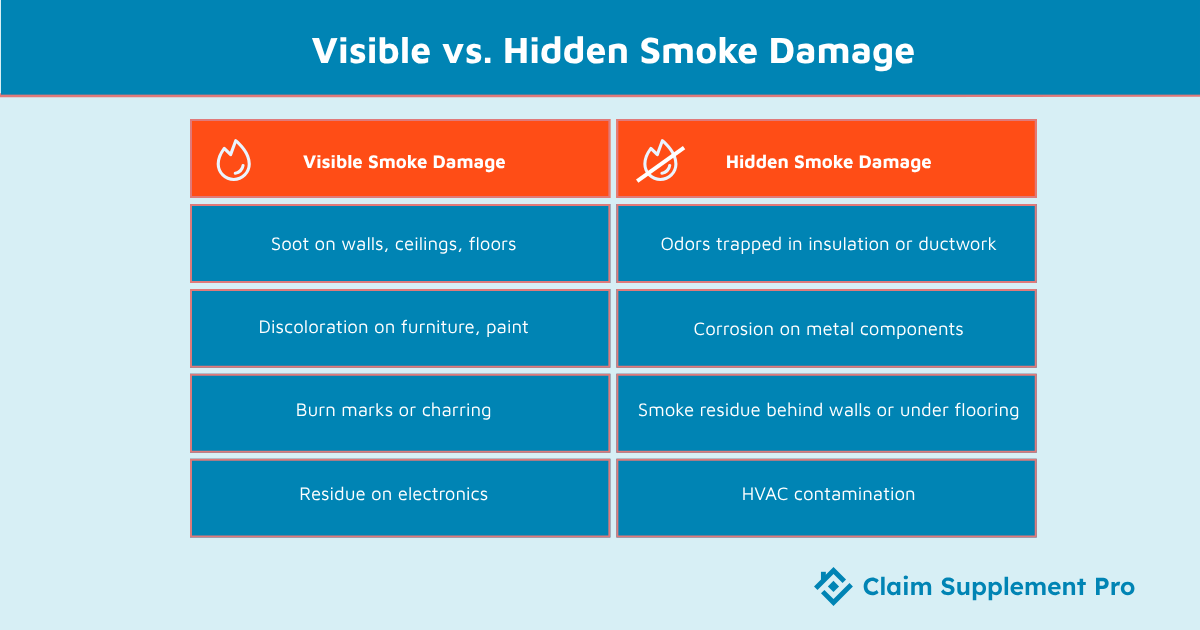

In the eyes of insurance carriers, smoke damage isn’t just what you can see. It includes both visible and hidden effects caused by smoke and soot from a fire. Common examples include soot residue on walls, ceilings, and furniture, lingering smoke odors infiltrating HVAC systems, corrosion on metal surfaces, and discoloration or staining of paint, fabrics, and electronics.

Secondary damages can also occur if smoke-contaminated materials aren’t cleaned promptly or properly, such as lingering odors, compromised air quality, or accelerated material deterioration. However, all of these costs are often overlooked in initial claims, which is why a thorough evaluation is essential for a fair payout.

You should document both visible and hidden damage to ensure the smoke damage insurance claim process can cover the full scope of loss.

The Smoke Damage Insurance Claim Process: Step-by-Step

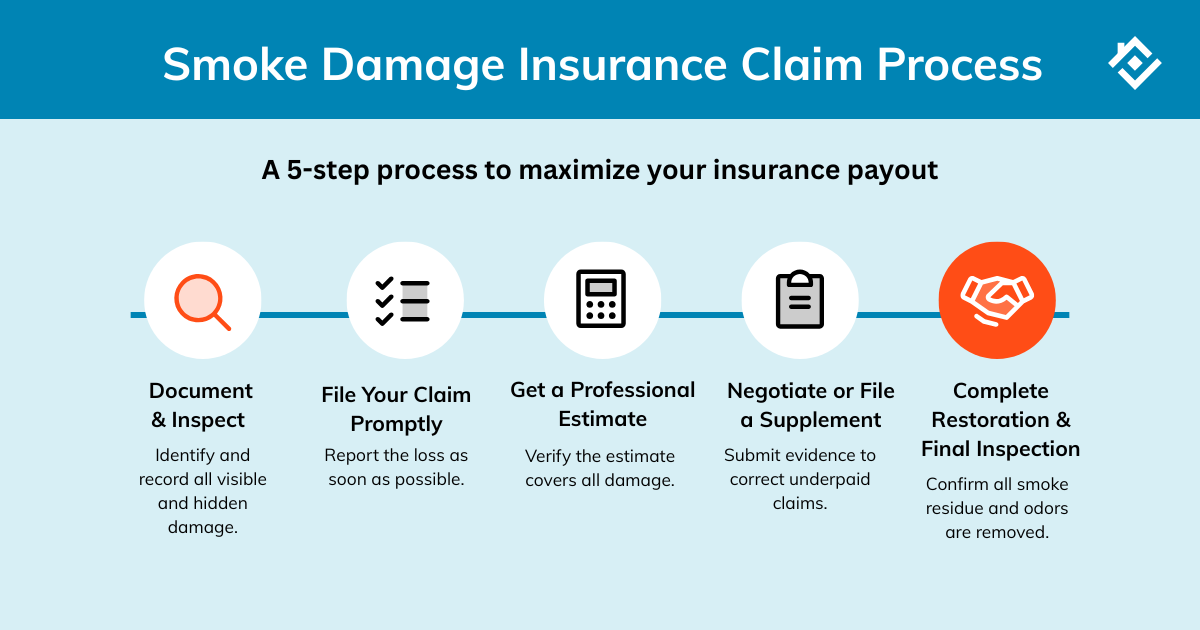

Filing an insurance claim for smoke damage can get complicated, especially as the signs aren’t always visible. Understanding each stage of the process helps avoid missed supplements, underpayments, and unnecessary delays. We’ll help you do this by guiding you through handling the smoke damage insurance claim process from start to finish.

Step 1 – Document and Inspect Thoroughly

The foundation of every successful smoke damage insurance claim is thorough documentation. This is your time to shine in the art of photography—start by photographing every affected area and item, including walls, ceilings, floors, and contents like furniture or electronics.

Create a detailed inventory list and note any strong or lingering odors; odor test results can be invaluable later when negotiating coverage for deodorization or HVAC cleaning.

Don’t forget the hidden areas. Attics, ductwork, and air handling systems often harbor smoke particles and soot even if the main living space appears untouched. A professional inspection using particulate meters or odor detection tools can help reveal damage invisible to the naked eye.

Step 2 – File a Smoke Damage Claim Promptly

This isn’t one of the times when you should follow the mantra: “Good things come to those who wait.” Timing matters. Notify your insurance provider as soon as possible after the incident.

Delaying the smoke damage claim can raise questions about the source or severity of the damage, potentially reducing your payout or coverage eligibility. Early reporting also allows adjusters to assess the property before cleanup removes key evidence.

Step 3 – Get a Professional Estimate or Supplement Review

Insurance estimates often miss critical components that may not be immediately obvious, such as contents cleaning, odor removal, or corrosion treatment for electronics and metal fixtures. A professional restoration estimator can identify these omissions and help ensure the claim reflects the actual scope of the damage.

If you’re unsure whether your claim estimate is accurate, our professional estimating services team can provide a detailed review and supplement preparation to support your negotiation.

Step 4 – Negotiate the Claim or File a Supplement

If your insurance claim for smoke damage is underpaid or coverage appears limited, you have the right to request a supplement. Supplements include additional documentation, photos, or expert reports that justify the true cost of repair or cleaning.

If you need guidance on how to handle an underpaid claim, we are here for you.

Step 5 – Complete Restoration and Final Inspection

Once the claim is approved and restoration begins, proper remediation is key. This includes soot removal, deodorization, and post-restoration air quality testing to confirm that all smoke residues and odors are eliminated.

A final walkthrough ensures that no hidden smoke damage remains and that the property is truly restored to its pre-loss condition.

What Not to Say to an Insurance Adjuster About Smoke Damage

Words have the power to change things for the better or for worse. When speaking with an insurance adjuster after a fire, every word matters. Your well-intentioned comments can unintentionally weaken your claim for smoke damage. You might feel like you should try to minimize the situation to sound cooperative, but phrases like “It doesn’t look too bad” or “We can clean most of it easily” can significantly reduce your settlement value.

From an adjuster’s perspective, such statements may suggest the damage is minor, which can result in a lower payout and limited coverage of certain restoration line items. Smoke damage, however, is rarely just surface-deep. It can infiltrate insulation, ductwork, and porous materials, leaving hidden residues and odors that require professional treatment.

Before agreeing to any settlement or downplaying the extent of damage, always have a qualified contractor or supplement specialist document the loss thoroughly. Detailed inspection reports, moisture and particulate readings, and before-and-after photos provide objective proof of the true scope of restoration needed.

From a supplementing standpoint, documentation is your best defense. Accurate evidence allows you to justify necessary line items, be it deodorization and HVAC cleaning or corrosion treatment and content restoration. Only in this way can the claim reflect the real cost of returning the property to pre-loss condition.

Why Contents and Hidden Smoke Damage Often Get Missed

Smoke damage doesn’t stop at eye level. While insurance adjusters may focus on the structure, walls, ceilings, and flooring, the contents of a home or business space tell the rest of the story. Items like furniture, clothing, electronics, personal documents, and curtains absorb odor and soot particles that require specialized cleaning or replacement. Yet, these losses are frequently undervalued or completely left out of the initial estimate.

One major reason is that adjusters typically prioritize structural assessments over contents evaluation. In many cases, hidden damage also escapes notice as smoke can seep behind drywall, into insulation, through ductwork, and even beneath flooring. Without advanced inspection tools or thorough testing, these unseen areas remain unaccounted for, leading to incomplete or underpaid claims.

And this is exactly where experience makes all the difference. Claim Supplement Pro can help you identify and properly document overlooked damages, so that every affected area and item is accounted for. From HVAC cleaning and corrosion control to content restoration, our supplemental process bridges the gap between the adjuster’s initial estimate and the actual scope of work needed for full recovery.

For more insights on recognizing and addressing missed line items, see our detailed guides on fire restoration claim supplements and countering low adjuster estimates.

The True Cost of Missed Smoke Damage (and How It Impacts Contractors)

When smoke damage isn’t fully documented or properly supplemented, it’s not just the homeowner who loses out; contractors do, too. Every overlooked item means a smaller project scope, less billable work, and ultimately reduced profitability.

What’s worse, if hidden smoke damage resurfaces later, through lingering odors, staining, or corrosion, contractors may face callbacks or warranty claims for issues they were never properly funded to fix.

Accurate supplementing protects both your bottom line and your reputation. By ensuring every affected surface, system, and content item is included, you’re not only guaranteeing a complete recovery but also securing fair compensation for the full scope of your labor and materials. Make sure your claim is approved and your work is paid its worth.

Common Questions About Smoke Damage Insurance Claims

Will Insurance Cover Smoke Damage?

Yes, most standard homeowners and commercial property insurance policies include coverage for smoke damage, even if the fire itself was small or occurred in a nearby area.

Smoke damage is typically considered a “covered peril,” meaning the insurer should pay for repairs, cleaning, and odor remediation to restore the property to its pre-loss condition. However, coverage details depend on your specific policy, deductible, and the source of the smoke (for instance, wildfire vs. accidental indoor fire).

Can You Claim for Smoke Damage Without Visible Fire Damage?

Absolutely. You do not need visible flames or traces of fire to have a valid insurance claim. Smoke from a nearby fire, furnace puff-back, or electrical short can cause significant contamination and odor throughout a building.

In many cases, smoke alone can corrode metal, discolor walls, and infiltrate HVAC systems, all of which qualify as covered damage if properly documented.

How Do You Prove Smoke Damage?

Proving smoke damage relies on thorough documentation. Take high-resolution photos and videos of affected surfaces, furniture, and HVAC components. Record any discoloration.

Contractors often use tools like particulate testing and odor inspection methods to demonstrate the extent of damage. A professional inspection report or restoration estimate provides strong evidence when negotiating with insurers.

What Not to Say to an Insurance Adjuster?

Avoid minimizing the issue with statements that can make the insurer assume the damage is minor or resolved, leading to them underestimate the true costs.

Instead, focus on facts and evidence: present inspection reports, estimates, and expert findings. Let documentation, not opinion, speak for the extent of your loss.

How Long Do You Have to File a Smoke Damage Claim?

Try to notify your insurer immediately. Most insurance providers require filing a claim within 60 days, though this varies by state and policy type. Some commercial or complex residential policies may allow extensions if damage is discovered later.

Still, it’s best to file as soon as possible, as delays can lead to depreciation, coverage disputes, or claim denials. Acting quickly ensures evidence is fresh and your restoration costs are fully recoverable.

How Claim Supplement Pro Helps Contractors and Property Owners Maximize Smoke Damage Claims

When it comes to smoke damage, it’s way too easy to miss critical line items, especially those involving contents cleaning, deodorization, or HVAC restoration. That’s why Claim Supplement Pro is here to step in.

Our team performs detailed claim supplement reviews for both fire and smoke damage cases, and time after time, we’ve seen how identifying overlooked components can make a major difference in the final settlement. From unaccounted-for HVAC cleaning to odor control treatments, we’re here to make sure every valid repair and cleaning task is properly documented and reimbursed.

We work side by side with contractors, building complete estimates, strengthening documentation, and handling negotiations with insurance carriers. With our estimating expertise and supplementing experience, claims move faster and close at significantly higher payout amounts.

If you want to make sure nothing vanishes into smoke, explore our fire damage insurance claim supplements or see how our estimating services can help you secure the compensation your project truly deserves.

Smoke Damage Claims Don’t Have to Be Suffocating

Dealing with a fire is chaotic, but at least it comes with the urgency of the moment. Smoke damage, on the other hand, is the slow burn that follows: lingering, exhausting, and far too easy to underestimate. Still, with the right plan and proper support, you can catch your breath. Identifying both visible and hidden smoke damage on walls, furniture, air systems, and personal contents is the path to proper restoration with nothing overlooked.

Thorough documentation, expert estimating, and timely supplements are what turn an underpaid claim into a fair settlement. Claim Supplement Pro helps you navigate every step of that process, from uncovering missed items to securing complete compensation.

Contact us right away for a professional review of your fire or smoke damage claim. Clear the air, close the claim, and move forward.