Understanding the Commercial Supplement Process: A Contractor’s Guide

Table of Contents

- The Commercial Insurance Claims Process: A Quick Overview

- What Are the Steps in the Insurance Claims Process?

- What Is a Commercial Supplement? (And Why Contractors Need It)

- Common Types of Commercial Property Damages That Require Supplements

- The Contractor’s Role in the Supplement Process

- Why You Should Work With a Supplement Partner

- Top Mistakes Contractors Make with Commercial Supplements

- Let’s Finish the Job – and the Paperwork

When it comes to commercial property damage insurance claims, many contractors unknowingly leave a lot of money on the table. This happens due to the fact that the commercial insurance claims process can be complex, slow-moving, and often built around initial estimates that don’t capture the full scope of work. That’s where supplements come in.

So, what is commercial claims processing?

Commercial claims processing is the step-by-step evaluation and payout of insurance claims related to damage to commercial properties. For contractors, it often involves addressing gaps in incomplete scopes, compiling detailed documentation, and trying to supplement the original claim to ensure you’re paid for the work actually required.

This guide breaks down how commercial insurance claims work, where contractors tend to lose money, and how to utilize supplementing experts to your advantage. No matter if it’s fire, flood, or storm damage on a large-scale property you’re dealing with, understanding this process helps you stay profitable and avoid unnecessary headaches.

The Commercial Insurance Claims Process: A Quick Overview

When commercial property damage occurs, contractors are one part of a larger puzzle. The commercial insurance claims process typically involves four main players: the property owner (policyholder), the insurance adjuster, the contractor hired to perform the work, and, in many cases, a supplement specialist who helps ensure the contractor is paid fairly for the full scope of repairs.

What Are the Steps in the Insurance Claims Process?

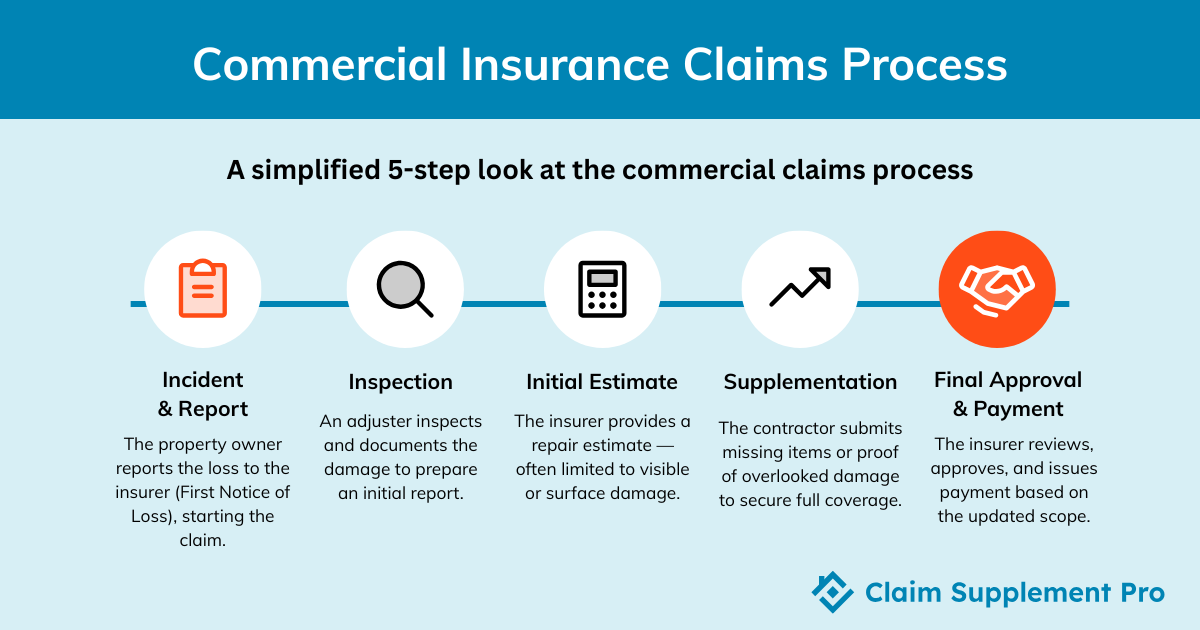

Here’s a simplified look at how most commercial claim processes unfold:

1. Incident & Initial Report

The property owner notifies their insurance carrier of the loss. This is the official First Notice of Loss (FNOL), which triggers the claims process.

2. Insurance Inspection

An adjuster is assigned to inspect the property and document the visible damage. This inspection informs the insurer’s understanding of what needs to be repaired or replaced.

3. Initial Estimate Issued

Based on the adjuster’s report, the insurance company creates a repair estimate. However, this estimate is often limited to visible or surface-level issues, overlooking damage that may only become apparent during demolition or deeper inspection.

4. Supplementation

This is where contractors must step in to protect their bottom line. If the initial estimate is incomplete or too low, the contractor (or their supplementing partner) submits additional documentation and a revised scope of work to request a higher payout. This phase is crucial in the commercial property insurance claims process, especially when dealing with complex damage, code upgrades, or hidden structural issues.

5. Final Approval and Payment

Once the supplement is approved, the claim is finalized, and the insurer issues payment based on the updated scope.

What Is a Commercial Supplement? (And Why Contractors Need It)

As discussed above, a commercial supplement is a formal request submitted to the insurance carrier to increase the original claim payout. It’s used when the initial estimate leaves out critical line items, such as labor, materials, code upgrades, or demo work, that are necessary to complete the job properly.

In the commercial insurance claims process, supplements are a tool for advocating fair compensation when the insurer’s estimate falls short. And it’s not rare that that happens.

Why Do Insurance Estimates Fall Short?

Insurance adjusters are often working under tight time constraints, especially after large-scale events like storms or fires. Their inspections tend to focus on visible damage and may not account for:

- Code upgrades required by the local municipality

- Temporary measures (e.g., drying equipment, temporary power)

- Scope items that are only discovered during the demo (like mold behind walls or damaged sheathing)

As a result, many commercial property damage insurance claims are underpaid by thousands of dollars.

Who Can Submit a Supplement?

Supplements can be submitted by the contractor directly, but many decide to work with a third-party supplement company that specializes in navigating carrier relationships and writing detailed, code-compliant estimates (e.g., in Xactimate). Besides saving your time and patience, this also improves the likelihood of approval, especially on high-value commercial claims.

Common Types of Commercial Property Damages That Require Supplements

In the commercial property damage insurance claims process, the most common types of losses often lead to underestimated scopes, and that’s where supplementing becomes essential. These jobs typically involve complex materials, strict local codes, and hidden damage that adjusters may miss during initial inspections.

Here are some real-world contractor scenarios where supplementing turned a profit-losing estimate into a fair payout:

- Fire Damage

A restaurant fire caused smoke and soot throughout the dining and kitchen areas. The adjuster’s estimate covered surface-level cleanup but missed the costs of odor remediation, duct cleaning, and demolition of smoke-damaged drywall. Supplementing added over $20,000 to the payout.

- Flood/Water Mitigation

An office building suffered a pipe burst that affected three floors. The initial estimate didn’t address slower drying times as evidenced by moisture mapping or drying logs, or replacement of damaged built-in cabinetry. A supplement was submitted with supporting documentation and photos, recovering an additional $15,000.

- Storm Damage (Wind/Hail)

A retail plaza’s roof needed full replacement, but the original scope only included patching. Supplementing added line items for full tear-off, new underlayment, flashing, and code-required upgrades, adding $30,000 to the claim.

- Mold/Remediation

A hotel had mold growth from a long-standing roof leak. The adjuster denied mold remediation, but a supplement supported by lab reports and photos secured approval for remediation protocols and repairs, totaling $20,000 in additional funds.

Each of these examples shows the criticality of the supplement process in ensuring fair payment during the commercial claim process. Without it, contractors often either eat the costs or walk away from the job altogether.

The Contractor’s Role in the Supplement Process

Contractors aren’t just builders, but key players in making sure the job is scoped and paid accurately. The outcome of a supplement request often depends on the quality of documentation you provide.

Why Documentation Matters

Adjusters can’t approve what they don’t see. That’s why every supplement request should be backed by:

- Clear job photos (wide shots, close-ups, timestamps)

- Moisture mapping logs (for water or mold-related claims)

- Evidence of code upgrades (like ADA compliance or energy code requirements)

- Before-and-after visuals (especially useful in proving the extent of mitigation work)

Building a Solid Supplement Package

When it’s time to request additional funds, what you submit matters just as much as how you submit it. A strong supplement package typically includes:

- A detailed scope of work (room-by-room or system-by-system)

- An Xactimate estimate with accurate line items and pricing

- Receipts or invoices for materials, equipment, and subs

- Local code references or city-mandated upgrades that justify added costs

Communicating With the Adjuster

It’s important to stay professional and proactive when communicating with the adjuster. Be prepared to explain why certain repairs or upgrades are necessary

and walk through the supplement line by line, if requested.

Also, always aim to respond quickly to documentation requests or questions. Consistency and clarity go a long way in speeding up the approval process.

Why You Should Work With a Supplement Partner

You might not have the time or the bandwidth to chase documentation, revise scopes, and negotiate payouts, and frankly, it’s not your job to do any of those. That’s where a supplement partner like Claim Supplement Pro steps in, reviewing scopes, building accurate Xactimate estimates, and taking the adjuster follow-ups off your plate.

In the background, a supplement specialist also makes sure your claims are clean, accurate, and compliant—no padding or guesswork, just well-documented value that holds up under scrutiny. We help translate insurance jargon into real-world scope, prevent costly mistakes, and ensure every justified line item is accounted for.

By offloading the paperwork, you can stay focused on the field while someone experienced is advocating for the full scope behind the scenes.

Top Mistakes Contractors Make with Commercial Supplements

Many contractors leave money on the table simply by not submitting supplements at all. Whether due to time constraints, uncertainty about the process, or assuming the initial estimate is final, this missed step can dramatically reduce the claim’s value.

Another common mistake is waiting too long. If you delay supplementing until after the job is finished—or worse, after final payment—your chances of approval shrink. Timing matters, and so does documentation. Without clear records of the damage, materials, and repairs (especially photo evidence and itemized breakdowns), it’s difficult to justify any additional costs.

Code upgrades are another blind spot. If you’re not referencing local building code requirements when applicable, you risk undercharging and footing the bill for work that should’ve been covered. Lastly, trying to manage the entire supplement process in-house, especially on larger or more complex commercial jobs, can stretch your bandwidth thin. When overwhelmed, it’s easy to miss critical line items or give up the follow-through.

Partnering with a supplement specialist ensures you avoid these pitfalls and stay focused on what you do best.

Let’s Finish the Job – and the Paperwork

Commercial jobs are rarely simple, and neither are their insurance claims. But keep in mind that submitting a supplement isn’t about asking for more, but about claiming what’s fair.

If you’re ready to stop settling for incomplete payouts, let Claim Supplement Pro help you submit, support, and secure the supplement you deserve.