Are Your Insurance Claims Getting Denied? Here’s How to Get Them Approved

Table of Contents

- What Does It Mean When an Insurance Claim Is Denied?

- Why Do Insurance Companies Deny Claims? (Top Reasons Explained)

- What Happens If an Insurance Claim Gets Denied?

- How to Respond to a Denied Insurance Claim

- How to Appeal a Denied Insurance Claim

- What Percentage of Insurance Claims Are Denied?

- Can Insurance Deny a Claim After Approval?

- How Contractors and Property Owners Can Get Denied Claims Approved

- Common Types of Denied Claims We Handle

- Frequently Asked Questions About Denied Insurance Claims

- Final Thoughts: Don’t Accept “Denied” as the Final Answer

Why do any of us pay for insurance? It’s so that when life throws stressful, unexpected situations our way, at least we don’t have to worry about the financial side of it. Unfortunately, having your insurance claim denied or only partially approved is a scenario that happens far more often than most people imagine. Instead of relief, property owners and contractors are left with stalled projects, unpaid repairs, and a sinking feeling that the very safety net they’ve relied on has been pulled away.

Industry reports show that about 37% of property damage claims faced denial across the entire U.S. in 2023. But why do insurance companies deny claims? Denials can stem from missing paperwork, vague policy language, exclusions in the fine print, or simply the fact that adjusters are human and may be overwhelmed after major disasters and need to rush through a backlog of claims. For homeowners, this means financial stress and unsafe living conditions. For contractors, it means lost time, delayed payments, and frustrated clients.

But here’s the good news: a partially approved or denied claim isn’t always the end of the road. In many cases, these outcomes can be challenged, appealed, and overturned with the right documentation and expert guidance. In this guide, we’ll explain reasons why insurance claims are denied or underpaid, what you should do if it happens, and proven steps to turn that “no” into the approval you deserve.

What Does It Mean When an Insurance Claim Is Denied?

An insurance denial means the insurance company has reviewed the claim and decided not to pay for all or part of the requested repairs. For contractors and property owners, this usually means stalled projects, unpaid invoices, and repairs left unfinished.

It’s also important to understand that denial isn’t always “all or nothing.” Many claims are partially approved – for example, an insurer may agree to replace one slope of a damaged roof but deny coverage for the rest, or approve siding repairs on one elevation of a building while denying the rest. These partial approvals can still leave property owners short on funds and contractors unable to complete the full restoration needed. Claim Supplement Pro specializes in all of these situations, identifying the gaps and advocating for fair coverage on the full scope of damage.

Finally, we have to differentiate between rejected and denied claims.

- A claim rejection often happens because of missing or incorrect information, meaning it was never fully processed in the first place.

- A claim denial means the claim was reviewed but not approved for payment, either in full or in part.

The key point to remember is that a denial doesn’t have to be the end. The right documentation, expertise, and persistence can lead to denied or partially approved claims being turned around.

Why Do Insurance Companies Deny Claims? (Top Reasons Explained)

According to the National Association of Insurance Commissioners (NAIC), the top reasons for consumer complaints are the delays in claim handling, followed by unsatisfactory settlements and claim denials.

Insurance carriers deny claims for many reasons, many of which come down to technicalities that property owners and even seasoned contractors can easily miss.

Let’s go over the most common reasons why insurance claims are denied:

- Policy Exclusions

One of the leading reasons for denial is when the damage simply isn’t covered under the policy. For example, a contractor may file a roof replacement claim after a hurricane, only to find that wind-driven rain is excluded, or that flood damage is categorized differently than water damage from a burst pipe.

- Late Filing or Missed Deadlines

Insurance policies typically have strict timelines for reporting damage. If a commercial fire claim is filed months after the incident, the carrier may argue that the delay prevented them from assessing the damage accurately, leading to denial.

- Insufficient Documentation or Proof of Damage

If photos, videos, or detailed contractor notes are missing, insurers may reject claims outright. For instance, a siding claim with no photos could be dismissed because the insurer cannot verify whether the damage was storm-related or mechanical.

- Pre-Existing Damage or Poor Maintenance

Insurers often deny roof or water damage claims by citing a lack of maintenance. A contractor may submit a claim for interior water damage, only to be told it resulted from long-term leaks or neglect, not a sudden covered peril.

- Disputed Costs / Scope of Work

Even when damage is acknowledged, insurers may deny parts of the scope as unnecessary or inflated. For example, they may approve drywall replacement but deny the supplement for electrical rewiring, leaving you to fight for essential items needed to restore the property properly.

What Happens If an Insurance Claim Gets Denied?

The impact of a denied insurance claim is immediate and stressful. If you’re a property owner, what happens is mounting financial strain, delayed repairs, and mixed feelings of fear and uncertainty about when or how the damage will be fixed. What happens for contractors is halting projects in their tracks, leaving their crews idle, and disrupting their cash flow. What was supposed to be a safeguard against risk suddenly creates even more of it.

We’re separating the two experiences because it’s important to understand the difference between first-party and third-party claims. A first-party claim is when the homeowner or property owner files directly with their own insurance company for coverage. A third-party claim is when a contractor submits on behalf of the homeowner, which is often the case after storm damage, fire, or other major events. In both cases, denials create significant roadblocks, but the dynamics of who communicates with the insurer and who absorbs the initial costs can differ.

But we won’t get tired of repeating it: a denied claim doesn’t mean the fight is over. Policyholders still have rights, and many denials and partial approvals can be successfully challenged with the right approach.

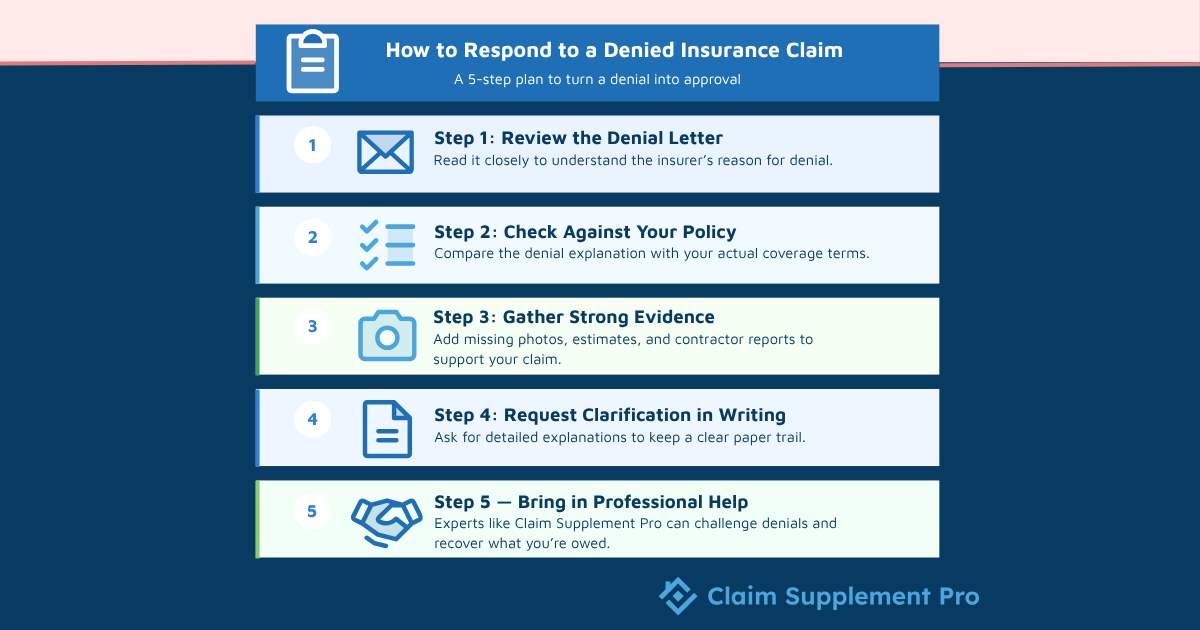

How to Respond to a Denied Insurance Claim

If it already happened, you must be thinking, “Okay, cut to the chase. How do I respond to a denied insurance claim?” — but the key is precisely that you do not panic. Instead, keep your composure and follow our structured process. A denial is for sure frustrating, but it’s also an opportunity to respond with the right information and strategy.

Step 1: Review the denial letter carefully.

Insurance companies must provide a written explanation for the denial. Read it word for word to understand their stated reason. Sometimes, it’s a technicality (like missing paperwork) rather than an actual coverage gap.

Step 2: Compare denial reasons against your policy coverage.

Match the denial explanation against the actual wording of the policy. Insurers may cite exclusions or limitations, but the policy language can often work in your favor with the right supporting evidence and the right support in helping you navigate the complexities of this language.

Step 3: Gather documentation.

Strong evidence is your best weapon. Collect photos of the damage, repair estimates, contractor reports, receipts, and expert assessments. The more detail you provide, the harder it is for insurers to dismiss your claim.

Step 4: Request clarification in writing.

If the denial letter feels vague, ask the insurance company to clarify their reasoning in writing. This ensures there’s a paper trail providing transparency of their justification.

Step 5: Know when to bring in professional help.

If the process stalls, don’t fight it alone. Public adjusters, attorneys, or supplement services like Claim Supplement Pro can step in to challenge denials, negotiate with insurers, and secure fair payouts.

Note for contractors: Explaining a denial or partial approval to homeowners can be delicate. Always be transparent about the situation, but emphasize that this isn’t the final word. If you position yourself as their advocate by showing them the steps that need to be taken, you preserve trust and strengthen your role as a problem-solver rather than just a service provider.

How to Appeal a Denied Insurance Claim

The good news is that policyholders have the right to challenge an insurer’s decision, and many claims that are denied at first can be successfully overturned. What will help in making this possible is following the proper process and backing up your request with solid documentation.

Review Insurer’s Appeal Process & Deadlines

Every insurance company has its own procedures for appeals, typically outlined in the denial letter or the policy itself. Deadlines are strict, sometimes as short as 30–60 days. Missing one can mean losing your right to contest the decision.

Submit Written Appeal With Supporting Documentation

An appeal should be in writing. In this letter, clearly explain why you believe the denial was incorrect. Attach all relevant evidence: photos, inspection reports, repair estimates, and expert assessments. A thorough submission means a stronger case.

Include Contractor’s Scope of Work and Estimates

For property damage claims, contractor input is crucial. Provide a detailed scope of work, material costs, and labor estimates to demonstrate the true cost of restoring the property.

Keep a Detailed Paper Trail

Every communication with the insurance company should be documented. Save emails, letters, estimates, inspection notes, and call logs. A strong paper trail supports your case and proves you’ve followed procedure if escalation becomes necessary.

Claim Supplement Pro specializes in negotiating denied and partially approved claims. By presenting detailed documentation, adjusting scopes of work, and negotiating directly with insurers, we work to increase your chances of covering all of your costs.

What Percentage of Insurance Claims Are Denied?

We mentioned at the beginning that, according to a Weiss Ratings report, the overall denial rate for homeowners’ insurance claims in 2023 was about 37%.

To make matters worse, this number likely understates the real issue, because many policyholders don’t even challenge denied claims or don’t have the resources to push back.

This shows just how important claim supplement services are. By ensuring no legitimate costs are overlooked and every detail is documented, we help reduce the chances of a denial and improve the likelihood of full approval.

Can Insurance Deny a Claim After Approval?

Most people assume that once an insurance claim is approved, the payout is guaranteed. While post-approval denials are rare, they can happen in certain circumstances:

- Fraud investigations (if the insurer later finds evidence of misrepresentation or inflated damages).

- Policy misrepresentation (for example, if the property owner provided inaccurate information during the application process).

- Administrative or adjuster error (mistakes in processing or approving coverage that the insurer later corrects).

From a legal standpoint, once payment is made, insurers generally have limited grounds to reverse a claim. That’s why most retroactive denials occur before funds are released.

In any case, the best safeguard against this scenario is comprehensive documentation at every stage, including photos, estimates, invoices, and code references. Not only does this support the original approval, but it also helps you defend the claim if it’s ever questioned down the line.

How Contractors and Property Owners Can Get Denied Claims Approved

Many denials are overturned once the claim is properly supplemented. The process usually involves:

- Reviewing the denial to identify why the insurer rejected or partially approved the claim.

- Adding missing documentation, such as detailed contractor estimates, photos, code references, or vendor quotes.

- Resubmitting the claim with a supplement package that directly addresses the insurer’s concerns.

When handled correctly, this approach results in:

- Higher approval rates

- Faster turnaround

- Financial protection

In our experience, it’s not uncommon for a roofing claim initially denied due to insufficient evidence of storm damage to be later approved after a contractor supplements the file with slope-by-slope photos, careful documentation, and an updated scope of work. The denial gets reversed, and full payment is issued.

Learn more about our Insurance Claim Supplement Services and make sure no part of your claim goes unpaid.

Common Types of Denied Claims We Handle

Insurance claim denials happen across many property damage categories. At Claim Supplement Pro, we regularly step in to challenge and overturn decisions on:

- Denied roof claims – Often denied for “wear and tear” when storm damage is really the cause.

- Denied fire damage claims – Disputes over smoke damage, code upgrades, etc.

- Denied water/flood claims – Frequently underpaid due to hidden moisture issues.

- Denied homeowners insurance claims – Covering each and any form of disaster damage.

- Denied commercial property claims – Larger-scale disputes involving business interruption, inventory loss, and equipment replacement.

Frequently Asked Questions About Denied Insurance Claims

Q: What happens if an insurance claim gets denied?

A denial means the insurer will not pay some or all damages, which delays repairs and creates financial strain. However, you can review the denial letter, collect stronger documentation, and submit a supplement or appeal to challenge the decision.

Q: How do I respond to a denied insurance claim?

Read the denial letter carefully, compare it with your policy, and gather proof such as photos and contractor estimates. Request clarification in writing, then resubmit with added documentation. If needed, bring in professionals like supplement services or attorneys to strengthen your case.

Q: What are 5 reasons why a claim may be denied or rejected?

The most common reasons are: policy exclusions, missed deadlines, lack of documentation, pre-existing damage or poor maintenance, and disputes over repair costs. Each of these can often be addressed by supplementing the claim with detailed evidence.

Q: Why would an insurance claim be rejected?

A rejection usually means the claim wasn’t processed due to errors like missing paperwork, incorrect details, or filing mistakes. Unlike a denial, it never even goes through a full review. Fortunately, rejected claims can usually be corrected and resubmitted.

Final Thoughts: Don’t Accept “Denied” as the Final Answer

A denied claim might feel like the end, but in reality, it’s often just the beginning of the fight for what you’re owed. Don’t let the delays, confusion, and frustration make you give up too soon.

With the right strategy, documentation, and support, most denials can be challenged and overturned. The key is to act quickly, stay organized, and bring in experts who know exactly how to push back.

If your insurance claim was denied, don’t shoulder the stress alone. Our team specializes in turning denials into approvals, giving you the fair outcome you deserve.